7 Steps for Success in 2024

2 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

To better position yourself for financial success in 2024 and beyond, here are some top tips to consider.

1. Develop a plan to reduce your debts and begin saving for the future.

Statistics Canada recently reported that household credit market debt as a proportion of household disposable income remains high at 181.57% ($1.82 in credit debt for every dollar of household disposable income).1

Your financial advisor can help you distinguish between good and bad debt and how you can approach tackling your debt.

2. Set up an emergency fund.

What would happen if you and/or your spouse lost your job? Would you have enough savings to cover your expenses while you look for another one? What if you have to replace the roof on your house or need to pay for a major repair on your car? Would that put you into debt?

Your financial advisor can help you set up an "emergency fund" so you have money set up to cover these types of expenses.

3. Review your savings goals and consider a tax-sheltered plan.

Maybe you want to save for a dream vacation. Or a new car or house. Or renovate your kitchen.

Does it really make a difference if you put the money into a registered plan such as a First Home Savings Account (FHSA) or Tax-Free Savings Account (TFSA), which can be used for any financial goal?

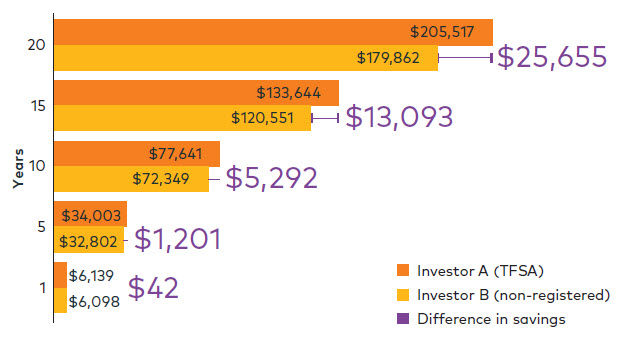

The chart shows the same amount of money ($500/month) being invested in the same product - a hypothetical investment with a 5% annual return.

The only difference: Investor A chose a TFSA account, while Investor B chose a non-registered account. After one year, the amount may not seem significant, but it makes a big difference over a longer time period.

4. Automate Your Savings and Investing – and Start Early.

Setting up a Pre-Authorized Chequing Plan (PAC), i.e., a regularly scheduled contribution that comes right off your paycheque or out of your bank account, can help build your savings with minimal effort. By investing regularly and following a consistent investment plan, you can take advantage of the benefits of compound growth, regardless of how much is invested.

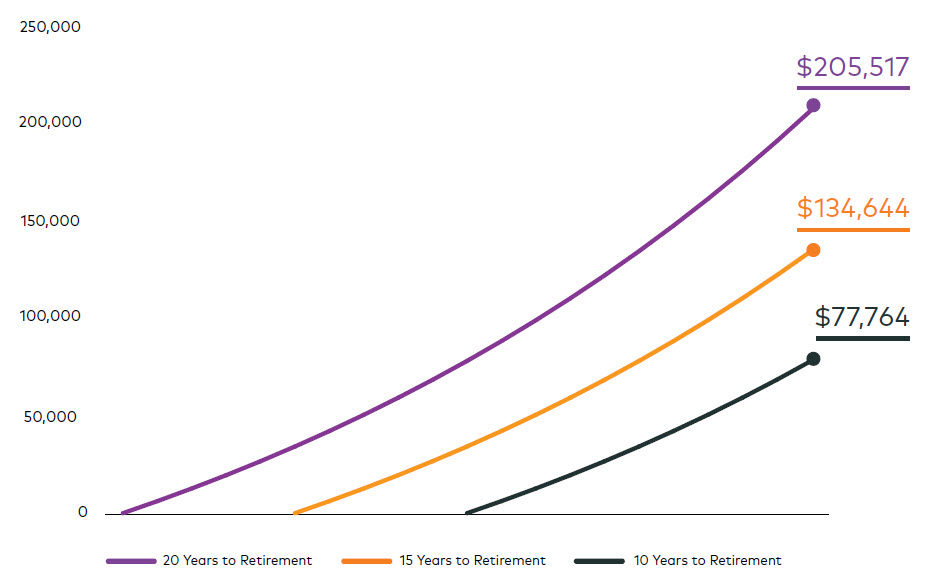

And the earlier you start, the better. In the example below, Investors A, B and C all invest $500 a month in a hypothetical investment that grows at 5% each year. By starting earlier, Investor A accumulated 50% more than Investor B – and nearly 3 times more than Investor C. All because of compounding returns.

BONUS TIP - Don't forget to increase your PAC or contribution amounts as you receive raises and get promotions.

5. Make Use of Your Company Benefits

Many companies offer employee savings or contribution matching plans. Check with your Human Resources department to see if you can take advantage of any employee programs that will help you build your savings faster.

6. Education Savings – Take Advantage of the Government Incentives

Did you know Registered Education Savings Plan (RESP) savings can be supplemented with government education savings initiatives? Read “Are you leaving money on the table?” to find out more.

If your child turns 15 this year and has never been a beneficiary of an RESP, you need to contribute at least $2,000 before the end of the year in order to receive the Canada Education Savings Grant (CESG) for 2024 and be eligible to receive the CESG for 2025 and 2026. Find out more at Is your child in high school?

7. Ensure Your Beneficiaries Are Up-To-Date

The beneficiary is the person or entity that will receive the proceeds from your account when you die.

By naming a beneficiary, you eliminate any doubt as to whom you want your money to go. If you haven’t specified one, the default is your estate – and there could be significant delays and paperwork involved to release the funds.

It’s up to you to make sure your beneficiaries reflect any changes in your life. Do they take into account any life events that have happened?

For more information on fulfilling any or all of these top tasks, contact your financial advisor. Don’t have a financial advisor? Before you start your search, read about working with a financial advisor.

1 Source: Statistics Canada. Table 38-10-0238-01 Household sector credit market summary table, seasonally adjusted estimates. Released December 13, 2023

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. This information is not meant as tax or legal advice. Investors should consult a financial advisor and/or tax professional before making investment, financial and/or tax-related decisions.

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.