Keep More to Grow More

2 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

One of the best ways to maximize your savings is to take advantage of tax-sheltered plans.

Tax Treatment of Non-Registered Investments

If you held an investment outside of a tax-deferred plan, you are required to report the following income on your Canadian income tax return*:

- Distributions in the form of interest, dividends or capital gains paid to you by any fund, including those reinvested

- Gains (or losses) realized when selling or redeeming units or shares of your fund

Tax Treatment of Registered Investments

On the other hand, distributions on funds held in a tax-sheltered plan do not need to be reported as taxable income and they are automatically reinvested:

- First Home Savings Account (FHSA)

- Registered Retirement Savings Plan (RRSP)

- Registered Retirement Income Fund (RRIF)

- Registered Education Savings Plan (RESP)

- Tax Free Savings Account (TFSA)

However, you are required to report on your Canadian income tax return* when money is withdrawn from a registered plan (the exception being a TFSA – because you’re investing with after-tax dollars, the amount withdrawn is not taxable).

For example, let’s say you decide to set aside $500 a month. Maybe you want to save for a dream vacation. Or a new car. Or to renovate your kitchen.

Does it really make a difference if you put the money into a tax-sheltered plan, such as a TFSA, which can be used for any financial goal?

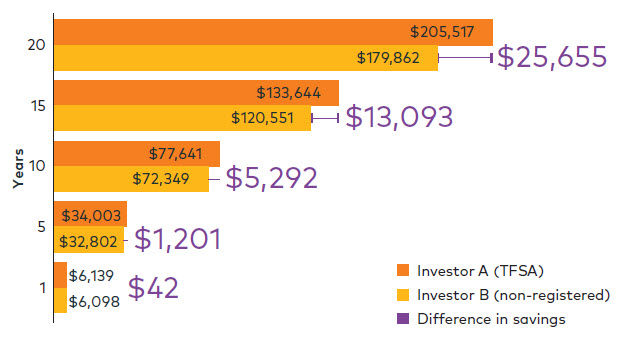

The chart below shows the same amount of money ($500/month) being invested in the same product (a hypothetical investment with a 5% annual return).

The only difference: Investor A chose a TFSA account, while Investor B chose a non-registered account. After one year, the amount may not seem significant but it makes a big difference over a longer time period.

To find out more about tax-sheltered plans, contact your financial advisor or visit the Registered Plans page on AGF.com.

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. This information is not meant as tax or legal advice. Investors should consult a financial advisor and/or tax professional before making investment, financial and/or tax-related decisions.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm and/or product is registered or authorized to provide such services.

AGF Investments Inc. is a wholly-owned subsidiary of AGF Management Limited and conducts the management and advisory of mutual funds in Canada.

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.