RESP Series

Are You Leaving Money on the Table?

3 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

Did you know RESP (Registered Education Savings Plan) savings can be supplemented with government education savings initiatives, with the main one being the Canada Education Savings Grant (CESG) paid by the federal government?

Key Facts about the Canada Education Savings Grant (CESG)

- All RESPs are eligible for Basic CESG

- The Government of Canada will match a percentage of your RESP contributions by depositing the CESG directly into the RESP

- $500 each year (20% of the first $2,500 of annual contributions per beneficiary)

- Up to $1,000 if carry-forward room is available (grant room is cumulative and can be carried forward). So if you cannot make a contribution in any given year, you can carry over unused Basic CESG.

- CESG paid into a Family Plan RESP may be used by any beneficiary of the RESP to a lifetime maximum of $7,200 per beneficiary – this includes both the Basic and Additional CESG

What determines if you are eligible for the CESG?

- Beneficiary and subscriber must have a valid SIN and be a Canadian resident

- Contributions must be made before the end of the calendar year the beneficiary turns 17

- Special rules apply to beneficiaries age 16 and 17

How much of a difference can the CESG make?*

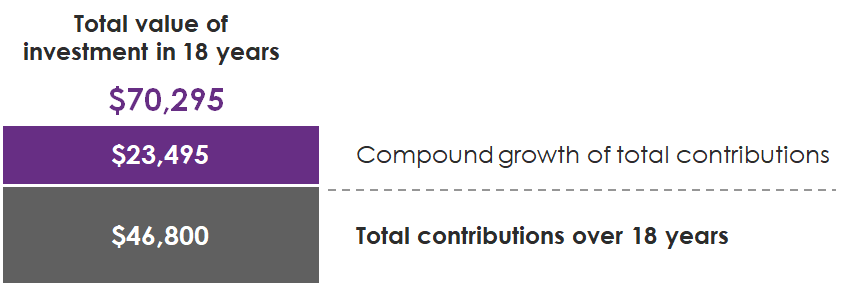

Family #1 – no CESG

- Invested $100 bi-weekly into a non-registered account

- This investment doesn’t qualify for the Canada Education Savings Grant (CESG)

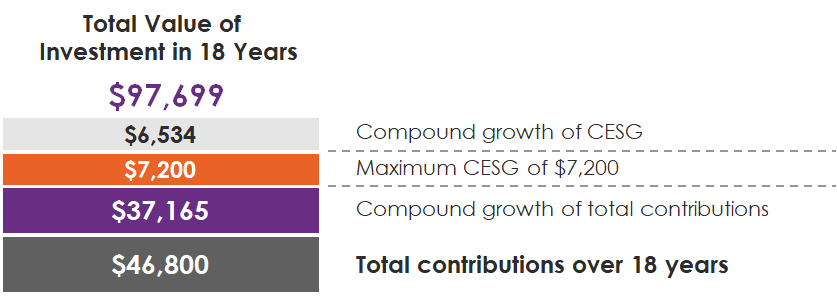

Family #2 – RESP with CESG

- Also invested $100 bi-weekly – but into an RESP account

- This investment qualifies for the CESG – 20% of their monthly contributions

Do you qualify for additional education savings grants?

Additional CESG is available to qualifying families**:

| Family Income | CESG Available |

| $0–$53,359 | $600: $500 (Basic CESG) + $100 (additional 20% on the first $500 of annual contributions per beneficiary) |

| $53,360–$106,717 | $550: $500 (Basic CESG) + $50 (additional 10% on the first $500 of annual contributions per beneficiary) |

How do I apply for the CESG?

- Ensure your tax returns are up to date

- Open and contribute to an RESP with the child named as a beneficiary – make sure the RESP promoter allows for the Additional CESG payment as not all do

- Complete the CESG application form. Your RESP provider will then request the CESG.

Once the application is approved, the appropriate amount will be deposited directly into that RESP.

Reasons for not receiving grant/bond monies on contributions to an RESP

Review your RESP statement transactions carefully to confirm government grant(s)/bond amounts received. Even if all the eligibility criteria has been met for the grant/bond in question, there are a number of reasons you may not have been paid the full amount owing on your contributions. These include:

- Missing/incomplete grant/bond application form(s)

- Missing/invalid beneficiary, subscriber and/or primary caregiver information or cases where this information does not match government records

- Lifetime grant/bond or contribution limits have been exceeded

- Grant/bond was paid to another RESP in the name of the same beneficiary

- Annual contribution limit was exceeded for contributions made before 2007

- Additional CESG, CLB, additional QESI, SAGES, and BCTESG are refused because not all beneficiaries in a Family RESP are siblings

- Additional CESG is denied because a beneficiary has been tainted by a contribution withdrawal made for non-educational purposes

- System/filing or administrative/processing errors

More information on RESPs and grant/bond eligibility criteria can be found at Student Financial Assistance.

Talk to a financial advisor to learn how they can help you and visit AGF.com/RESP.

And, if you have an AGF RESP, your financial advisor has access to a CESG calculator that can help determine how much needs to be contributed to an RESP, per beneficiary, to obtain the current calendar year's maximum CESG grant.

Understanding Volatility

Tips for staying calm when market volatility occurs

Subscribe

Get insights directly to your inbox

Subscribe Now