It Pays to Pay Attention to Interest Rates

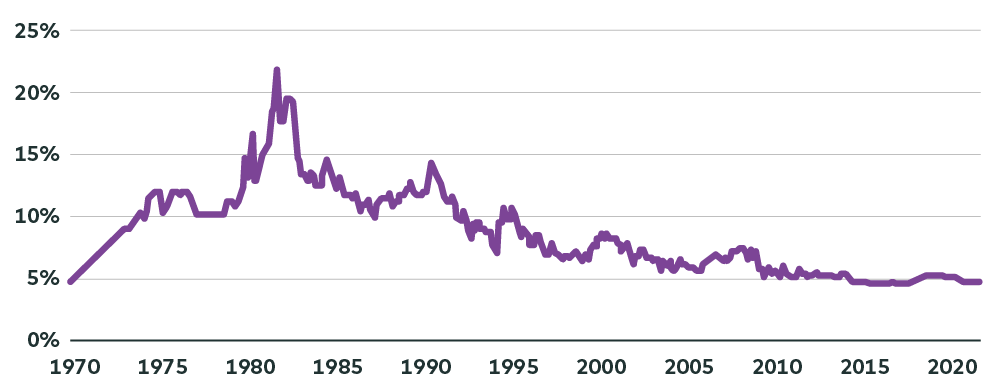

3 min readIn this age of low interest rates, it may be surprising to know that over the last 50 years, mortgage rates have generally hovered between 5% and 10%.1

Historical Posted 5-year Mortgage Rates

From 1973 - Today

It's perhaps even more shocking to see that in 1981, the interest rate for a 5-year fixed-rate mortgage was 21.75%.1 On a 25-year mortgage, the monthly payments2 are eye-popping, especially when compared to the latest posted rate of 4.79%1:

|

Mortgage |

Mortgage |

Monthly |

Additional |

Additional |

|

$100,000 |

4.79% |

$569.71 |

— |

— |

|

|

21.75% |

$1,745.45 |

$1,175.74 |

$14,108.88 |

|

$300,000 |

4.79% |

$1,709.13 |

— |

— |

|

|

21.75% |

$5,236.34 |

$3,527.21 |

$42,326.52 |

|

$500,000 |

4.79% |

$2,848.54 |

— |

— |

|

|

21.75% |

$8,727.23 |

$5,878.69 |

$70,544.28 |

Why were interest rates so high then? The Bank of Canada had raised interest rates to rein in inflation. So as frightening as these numbers are, we don't expect to reach those interest rate levels anytime soon.

Small Increases Can Have a Big Impact

That said, even a small increase in the interest rate can have a significant impact on your monthly payment, having a ripple effect on your financial budget and goals.

Use those same mortgage amounts, and again assuming a 25-year amortization period, let's look at a few examples using the latest posted rates:

- 2.79% = 1-year fixed rate4

- 3.49% = 3-year fixed rate4

- 4.79% = 5-year fixed rate4

|

Mortgage |

Mortgage |

Monthly |

Additional |

Additional |

|

$100,000 |

2.79% |

$462.54 |

— |

— |

|

|

3.49% |

$498.74 |

$36.20 |

$434.40 |

|

|

4.79% |

$569.71 |

$107.17 |

$1,286.04 |

|

$300,000 |

2.79% |

$1,387.61 |

— |

— |

|

|

3.49% |

$1,496.23 |

$108.62 |

$1,303.44 |

|

|

4.79% |

$1,709.13 |

$321.52 |

$3,858.24 |

|

$500,000 |

2.79% |

$2,312.68 |

— |

— |

|

|

3.49% |

$2,493.71 |

$181.03 |

$2,172.36 |

|

|

4.79% |

$2,848.54 |

$535.86 |

$6,430.32 |

What Can You Do?

Just like equity markets, real estate also has risks, such as the interest-rate risk discussed in this article.

Your financial advisor - whose job includes risk management - can help determine where real estate fits in your overall portfolio – helping ensure that you’re not taking on too much debt, that your other goals aren’t impacted and that your portfolio is appropriately diversified.

2Source: Financial Consumer Agency of Canada. Mortgage Calculator - Canada.ca (fcac-acfc.gc.ca).

3 Compared to 4.79%.

4 Mortgage Rate History - Super Brokers.

5 Compared to 2.79%.