FAQs about the FHSA

Brought to you by Sound Choices - AGF Education for Investors and Advisors

Here are answers to some of the questions we've been receiving about the First Home Savings Account (FHSA) – a new registered plan that will allow investors to save on a tax-free basis for their first homes.

- Who is eligible?

- What do you mean by a "first-time home buyer"?

- How will you know if I'm a qualifying individual and eligible to participate in an FHSA?

- I qualify as a first-time home buyer and opened an FHSA account, but I'm now moving in with / marrying someone who owns the house we'll be living in. What happens to my FHSA?

- As with an RRSP, contributions to an FHSA are tax-deductible. Will this impact my RRSP contribution limit?

- Can I contribute to a Spousal FHSA?

- If you open an FHSA in 2023, but don’t contribute in 2023 or 2024, how much can you contribute in 2025?

- What kinds of property can be a qualifying home?

- Can you withdraw money from an FHSA without incurring tax?

- How long can the FHSA stay open?

- What happens to unused FHSA money?

- You can transfer money from another registered plan to an FHSA. Which transfers are tax-deductible?

- How does this fit in with the HBP?

Who is eligible?

To open an FHSA, you must be:

- An individual resident of Canada

- At least 18 years of age*

- A first-time home buyer

What do you mean by a "first-time home buyer"?

To qualify as a first-time home buyer, you, or your spouse or common-law partner ("spouse")**:- did not own a qualifying home that you lived in as a principal place of residence

- at any time in the year the account is opened or the preceding four calendar years**

It's important to note that the principal residence doesn't have to be in Canada. So an immigrant to Canada may have to wait five years to qualify as a first-time home buyer if they sold their principal residence immediately before coming to Canada.

How will you know if I'm a qualifying individual and eligible to participate in an FHSA?

The holder must be a Canadian resident at least 18 years old and will attest on the AGF application form that they are a first-time home buyer.

And as you also need to be a first-time home buyer to qualify for a "tax-free" withdrawal, you will be asked to confirm that on the withdrawal form as well.

Additionally, the Canada Revenue Agency will provide AGF taxpayer information necessary to administer and enforce the FHSA. For example, letting us know that you've already made a qualifying withdrawal on another FHSA, so we'd need to contact you about closing the AGF one.

I qualify as a first-time home buyer and opened an FHSA account, but I'm now moving in with / marrying someone who owns the house we'll be living in. What happens to my FHSA?

If your spouse or common-law partner owns your principal residence, you cannot open a new FHSA, but can keep any pre-existing FHSA.

Remember, though, that you also have to qualify as a first-time home buyer to do a tax-free withdrawal. So, if the principal residence is sold, you could use the FHSA to purchase a new principal residence five years later, provided you qualify as a first-time home buyer and your FHSA account hasn't been open for more than 15 years (and you're younger than 71).

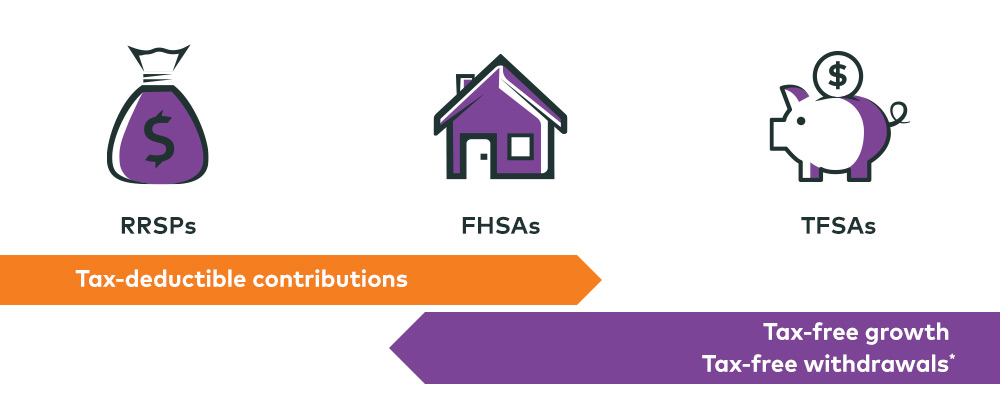

Similarities with RRSPs and TFSAs

* Qualifying withdrawals only.

As with an RRSP, contributions to an FHSA are tax-deductible. Will this impact my RRSP contribution limit?

No, the RRSP and FHSA are two separate plans. To open an FHSA, the main criteria is that you qualify as a first-time home buyer.

Similarly, if you've maxed out your RRSP contribution room, you can only open an FHSA if you qualify as a first-time home buyer.

Can I contribute to a Spousal FHSA?

There isn't a spousal version of the FHSA and the only person who can contribute to an FHSA is the owner of the account.

You can gift the money to your spouse. They would then contribute it and get the tax deduction.

It's the same with your children – you can gift them the money, but they will be the owners of the account and claiming the tax deduction. (You don't have to claim the tax deduction in the year that it's made though – they may want to wait until they're earning more income to claim it.)

If you open an FHSA in 2023, but don’t contribute in 2023 or 2024, how much can you contribute in 2025?

$16,000. Let's look at how we came to that number:

- Contribution room starts accumulating once the FHSA has been opened.

- Carryforward amounts accumulate from the year after the year the FHSA was opened.

- Unused contribution room can be carried forward to a maximum of $8,000, which means contribution room is capped at $16,000.

So if you open an FHSA in 2023 but don’t contribute – in 2024, you can contribute $16,000.

And if you don’t contribute in 2023 or 2024, in 2025 you can still only contribute $16,000 (not $24,000) – and then in 2026, you can contribute up to $8,000 and/or start accumulating carryforward room again.

What kinds of property can be a qualifying home?

A qualifying home is a housing unit located in Canada, including existing homes and those being constructed.

Here are some examples that qualify: Single-family and semi-detached homes; townhouses; mobile homes; condominium units; apartments in duplexes, triplexes, fourplexes, or apartment buildings; or a share in a co-operative housing corporation that entitles you to own and gives you an equity interest in a housing unit.

Can you withdraw money from an FHSA without incurring tax?

Yes, if it's a qualifying withdrawal.

Qualifying withdrawals:

- Will be non-taxable if being used towards the purchase of a qualifying home and the investor still qualifies as a first-time home buyer when making the withdrawal

- Are not taken into account in determining eligibility for income-tested benefits or credits (for example, the Canada Child Benefit, GST Tax Credit)

- Must have written agreement to buy or build a qualifying home before October 1st of the year following the withdrawal

- The property must be used as a principal residence – not a leisure property – and occupied within one year of acquisition

On the other hand, taxable withdrawals would be subject to withholding tax and the amount withdrawn included in the investor's income for that year.

Examples of tax withdrawals include:

- Investor is no longer a Canadian resident at the time of the withdrawal and/or when the qualifying home is bought or built

- Investor is no longer a first-time home buyer

- Withdrawal is not used for purchasing a qualifying home

- Money withdrawn to close an FHSA (and wasn't transferred tax-free to an RRSP or RRIF)

How long can the FHSA stay open?

The FHSA timeframe focuses on the individual and not the account.

Maximum participation period for a qualifying individual ends at the earliest of the following events:

- The end of the 15th year since the investor’s first FHSA was opened OR

- The end of the year the investor turns 71 years old OR

- The end of the year after the year a qualifying withdrawal was made OR

- The end of the year after the year of the investor’s death

Once any of these events take place, the individual would not be able to open another FHSA, regardless of whether they otherwise fit the criteria for a qualifying individual.

So if you open an FHSA at aged 18, you would have to buy a house by aged 33 to take advantage of the FHSA qualifying withdrawal benefit.

What happens to unused FHSA money?

Any savings not used to buy a home can be transferred tax-free to an RRSP or RRIF or withdrawn on a taxable basis.

If the FHSA remains open past any of the deadlines mentioned above, the FHSA becomes taxable.

You cannot transfer from an FHSA tax-free to a TFSA. This is because contributions to an FHSA are tax-deductible. So you haven't paid tax on that money. Withdrawals from a TFSA are tax-free so you need to pay tax on it before the money goes into a TFSA.

You can transfer money from another registered plan to an FHSA. Which transfers are tax-deductible?

First, you can only transfer to an FHSA from an RRSP or TFSA. You cannot transfer from an RESP or RRIF to an FHSA.

Second, it depends whether the investor has already received a tax deduction for that invested money.

You would have already received a tax deduction for the RRSP contribution so you wouldn't get another one for money transferred from an RRSP to an FHSA. Funds can be transferred tax-free from an RRSP to an FHSA or from an FHSA to an RRSP with no impact to the investor's RRSP contribution room

But any money invested in a TFSA that's transferred to an FHSA would now qualify for a tax deduction.

How does this fit in with the HBP?

The Home Buyers' Plan (HBP) and FHSA are two separate plans.

With the HBP, you're essentially borrowing money from your RRSP to help buy or build your first home:

- You can withdraw up to $35,000 from your RRSP (and your spouse can too for a total of $70,000).

- You have 15 years to pay back the amount you withdrew, and must start paying it back in the second year after you buy your home.

- The minimum payment each year is calculated by the CRA as the balance owing divided by the years remaining in the 15-year repayment schedule.

For both, you have to qualify as a first-time home buyer to withdraw the money.

And if you and your spouse both qualify, you can use both plans. In other words, funds from an FHSA and Home Buyers’ Plan (HBP) can be used together for the same purpose – up to $75,000 each in capital, plus any growth in the FHSA.

For more information on how this new registered plan may help you and your family, contact your financial advisor and visit AGF.com/FHSA.

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The information contained in this document is designed to provide you with general information and is not intended to be tax advice applicable to the circumstances of the investor. Investors should consult their investment professionals and tax advisors prior to implementing any changes to their investment strategies.

The contents of this website are provided for informational and educational purposes, and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. Please consult with your own professional advisor on your particular circumstances.

AGF Investments is a group of wholly owned subsidiaries of AGF and includes AGF Investments Inc., AGF Investments America Inc., AGF Investments LLC, and AGF International Advisors Company Limited. The term AGF Investments may refer to one or more of the direct or indirect subsidiaries of AGF or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

® TM The “AGF” logo and all associated trademarks are registered trademarks of AGF Management Limited and used under licence.

RO 2947576 / 3031122

Originally published June 12, 2023 / Updated July 27, 2023