Women and Investing

2 min readWomen Now Control More Wealth

Control 32% of total global private wealth.1

And projected to control C$3.8 Trillion in wealth in Canada by 2028.2

And Not Just Through Wealth Transfer

More than 40% of Canadian households report women as the primary breadwinners3

Women’s earnings 47% of family income4

Half of millennial women created their own wealth5 and nearly 80% of women will be the sole financial decision maker for their household, often for two decades or more.6

But Still Face the Gender Effect in Their Finances

Women live longer, so retirement savings need to last longer.7

Women on average earn 87% of what men earn, resulting in a lifetime pay inequality.8

Women are 3 times more likely to leave the workforce to take care of others4 resulting in Canadian women retiring with 30% less wealth than men.9

A Few Key Strategies Could Make All the Difference

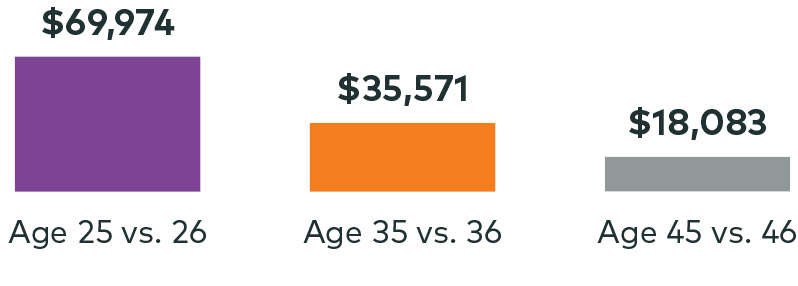

Start Now.

Even one year can potentially make a big difference at age 65.

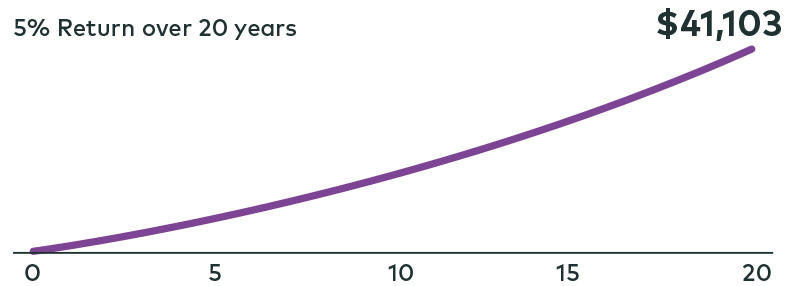

Invest Regularly.

Every little bit helps, even $100 a month.

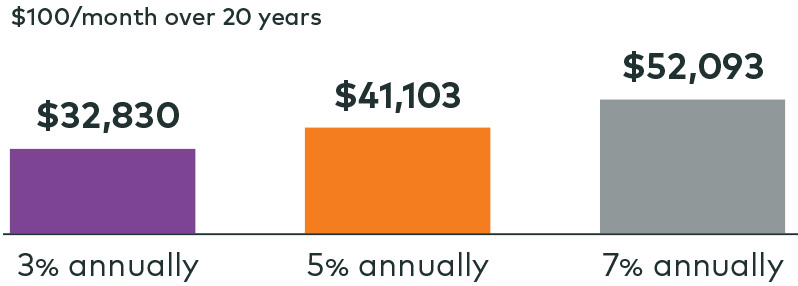

Boost Your Returns.

What you invest in can make a huge difference over the long term.

The role of a financial coach

Want to improve what you eat, consult a nutritionist. Want to make the best use of your time at the gym, hire a personal trainer. Want to improve your finances, hire an advisor.

An advisor can evaluate your entire financial situation, and build a plan to get you started.

33% of women reported having a financial advisor.10

73% of those regret not doing it sooner.10

To better understand investing, please contact your financial advisor. Don’t have a financial advisor? Before you start your search, read about working with a financial advisor.

2Source: The Changing Landscape of Women’s Wealth, CIBC Economics, released March 4, 2019.

3Source: Women in Canada: A Gender-based Statistical Report The Economic Well-Being of Women in Canada, Stats Canada, 2018.

4 Source: The Changing Landscape of Women’s Wealth, CIBC Economics, released March 4, 2019.

5Source: The new face of wealth and legacy: Redefining wealth and giving, Economist Intelligence Unit in partnership with RBC Wealth Management, June 12, 2018.

6Source: https://www.cnbc.com/2022/04/27/op-ed-recent-widows-need-guidance-with-money-issues.html.

7Source: Statistics Canada, released November 27, 2023.

8Source: https://payequity.gov.on.ca/the-gender-wage-gap-its-more-than-you-think.

9Source: https://www.mercer.com/en-ca/insights/investments/market-outlook-and-trends/addressing-the-retirement-savings-gap.

10Source: 2023 Women Money Power Study, Allianz Life, February 2024.

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. This information is not meant as tax or legal advice. Investors should consult a financial advisor and/or tax professional before making investment, financial and/or tax-related decisions.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm and/or product is registered or authorized to provide such services.

AGF Investments Inc. is a wholly-owned subsidiary of AGF Management Limited and conducts the management and advisory of mutual funds in Canada.

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.