When the Bear Comes out of Hibernation

2 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

Bear Markets: What You Need to Know

What is a bear market?

A bear market is triggered by a market decline of 20%. Each stock market will enter bear market territory at slightly different times depending on when they reach that 20% drop.

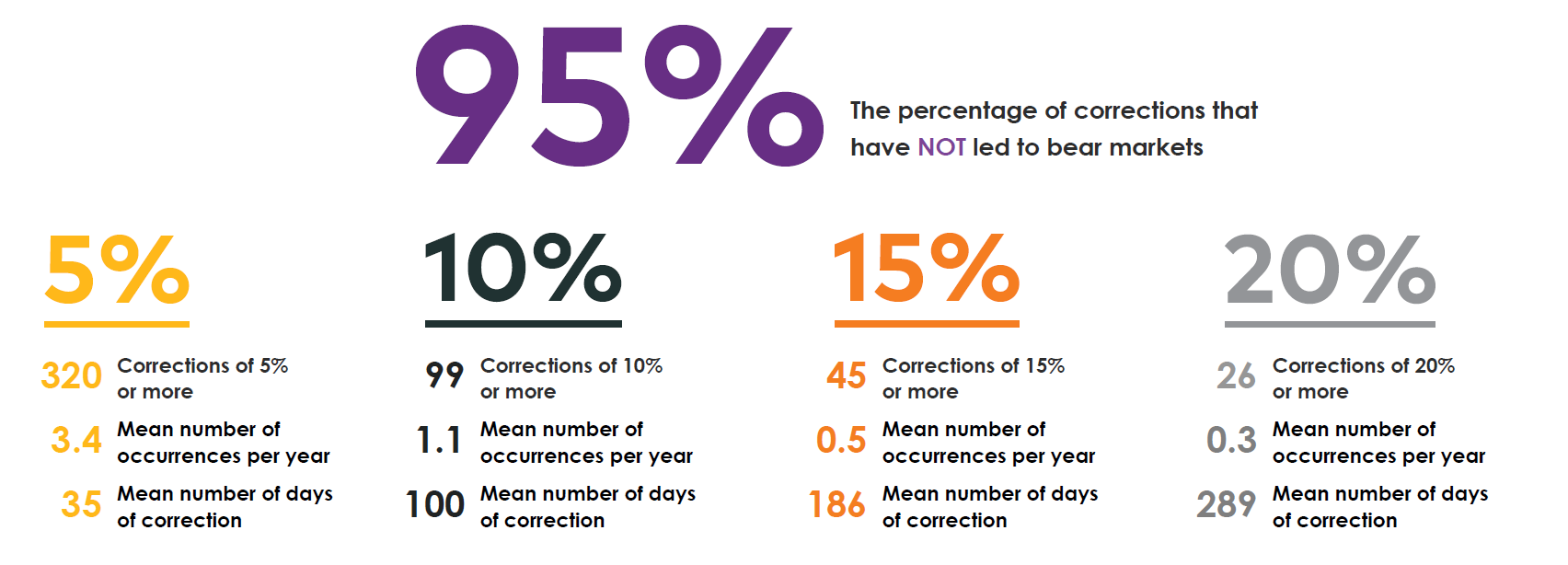

Based on Ned Davis Research data of S&P 500 Index performance between January 3, 1928 and February 22, 2022. One cannot invest directly in an index.

Bear market ≠ economy

A market decline doesn’t necessarily mean that the economy is in trouble. Over the past century, there have been more than two dozen bear markets on the S&P500, but only 15 economic recessions* – which is defined by the economy experiencing two or more quarters of negative growth (or decline).

That said, a bear market can occur hand in hand with an economic recession. And as with the stock markets, individual economies can go into recession at different times.

Bear markets are short-lived

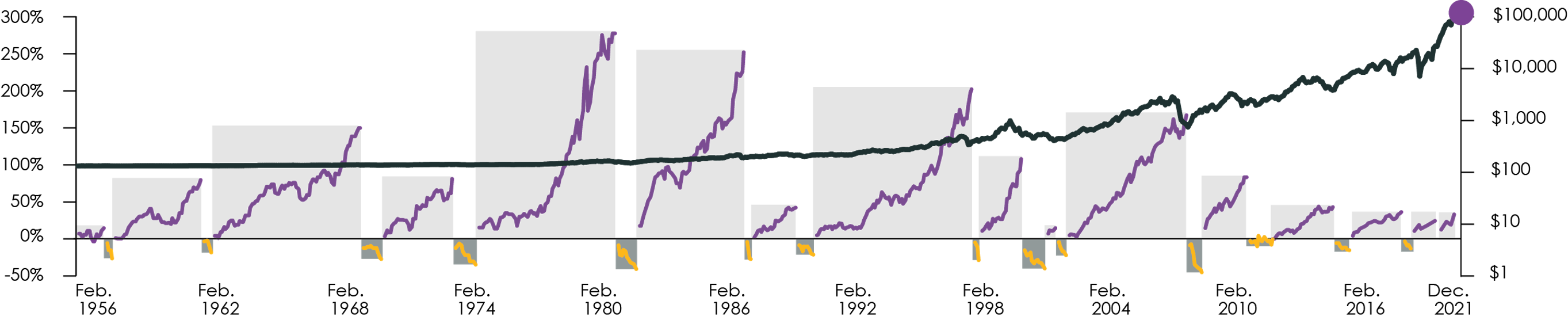

The average bear market lasts less than a year.

The chart below shows the bull and bear markets in the Canadian stock market over the past 60-plus years. The bull markets (purple line) on average lasted longer (41.6 months vs. 8.2 months) and their average gain (103.6%) was higher than the average drop during the bear markets (-24.6%).

How can you protect yourself from the bear?

As in real life, you probably shouldn’t run from a bear (market).

Reach out to your financial advisor who can help ensure your portfolio is diversified appropriately for your risk level, investment goals and time horizon.

And if you have questions about market volatility, visit AGF.com/volatility. There you’ll find articles and videos that discuss the current markets as well as providing context and tips for managing volatility on an ongoing basis.