Education Savings

Before You Make a Withdrawal From Your RESP…

3 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

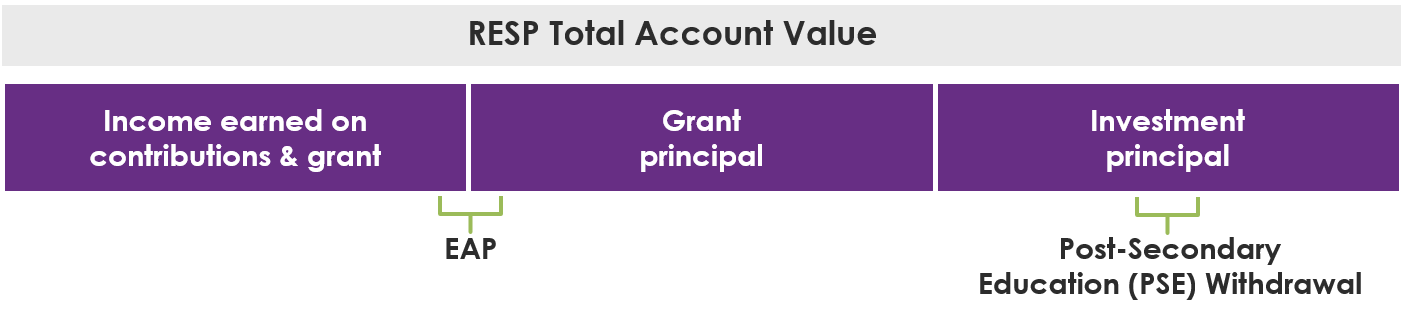

There are two types of withdrawal options:

1. Education Assistance Payment (EAP)

- Consists of earnings or “accumulated income” plus the grants themselves

- When withdrawn, the EAP is taxed in the hands of the beneficiary – a T4A tax slip is issued in the beneficiary’s name and must be included as income for the year that the beneficiary receives it

- Current proof of enrolment in a qualified (full-time) or specified (part-time) post-secondary education program is required before a payment can be processed

2. Post-Secondary Education (PSE) Withdrawal

- Consists only of contributions (investment principal) in the RESP

- Not taxed since contributions were made with after-tax dollars

- Since the beneficiary is pursuing a post-secondary education, the subscriber may withdraw their contributions without repaying any grant amounts or paying any tax

FAQs

Q: Is there a limit on the amount of EAPs a beneficiary may receive?

A: EAPs are limited to $8,000 before a beneficiary completes the first 13 consecutive weeks in a full-time qualifying educational program. Students requiring more than $8,000 in EAPs in the first 13 weeks require prior approval from the Employment and Social Development Canada (ESDC). Once the 13 weeks are completed, full time students can receive any additional amount of EAP. Part-time students are limited to $4,000 every 13 weeks they are enrolled in a specified educational program.

Q: What documentation is required?

A: AGF requires:

- A letter of direction (or AGF RESP Redemption Form) signed by the subscriber.

The subscriber confirms the amount of the withdrawal and the proportion of EAP and PSE. - Proof of enrolment is required for EAP and PSE redemptions for educational purposes only.

The requirements pertain to all institutions – including both Canadian or foreign institutions

Q: What counts as proof of enrolment?

A: The Federal Government (ESDC) provides the following guidance:

"Before making EAPs, obtain proof that a beneficiary is enrolled in a program and institution that satisfies EAP criteria. A document that provides the following information would generally be acceptable proof of enrolment for EAP purposes.

- Beneficiary name

- Post-secondary school name

- Date when proof was issued.

- Semester(s) or school year

- Indication that beneficiary is enrolled full- or part-time."

So when requesting an EAP or PSE withdrawal, please provide documentation with the following information:

- School is a Post-Secondary Institution.

- Letter Issued by Office of Registrar, or printed from school website with full name of school indicated.

- Student’s Full Name.

- Student’s program of study

- Program type (university, college, trade college or other)

- Course start & end dates (Academic Year must be the current year or within past 6 months).

- Course description with credit hours or course type Full Time/Part Time is indicated.

Q: How are withdrawals made for educational purposes taxed?

A: EAPs (consisting of grant and income) are always taxed in the hands of the beneficiary – generally beneficiaries are in a lower tax bracket than the subscriber. For more information, contact a tax specialist. PSEs are not taxable.

Q: How much of the EAP is the CESG?

A: The portion of the EAP attributable to the Canada Education Savings Grant (CESG) is based on the ratio of grants paid into the plan to total investment earnings in the RESP. CESG are limited to $7,200 per beneficiary. This is important to keep track of in family plans, where the CESG money is shared among the beneficiaries. For more information, read the articles on the CESG and family plans.

Q: How many years can the beneficiary who attends a qualified post-secondary institution receive EAPs?

A: According to the Income Tax Act (ITA), there are no specific restrictions on the number of years a beneficiary may attend post-secondary educational institution and receive EAPs. However, each RESP must be terminated no later than the 35th year after the year in which the original plan was opened.

Q: What if the beneficiary is not enrolled at the time of the withdrawal?

A: Technically, a subscriber can choose to withdraw all their contributions and use them in any way – regardless of whether or not the beneficiary goes to school. However, if their contributions are withdrawn while the beneficiary is not eligible for an EAP, the grants received will be repaid to the government.

For more information on RESPs, visit AGF.com/RESP or contact your financial advisor.

And, if you have an AGF RESP, your financial advisor has access to an RESP calculator that can help determine how much EAP and PSE Capital is available to be redeemed.

Understanding Volatility

Tips for staying calm when market volatility occurs

Subscribe

Get insights directly to your inbox

Subscribe Now