TFSAs

TFSAs

The Tax Free Savings Account (TFSA) allows you to save money each year without paying any tax on the investment income (interest, capital gains or dividend income) you earn.

There are so many things you can save for by using a TFSA. It might be to renovate your home, buy a cottage, go on a vacation or save for your child's wedding or your retirement. It could even be just to have emergency funds readily available.

The Basics

To open a TFSA, you will need:

- A valid Canadian Social Insurance Number

- To be at least 18 years old

- To be a Canadian resident

You do not need to have earned income or be filing an income tax and/or benefit return.

Key facts

| Contribution Deadline |

|

| Contribution Limit |

|

| Carry Forward |

|

| Eligibility |

|

| Government benefits |

|

| Minimum Age |

|

| Maximum Age |

|

| Spousal Contribution |

|

| Overcontribution penalty |

|

| Tax Features |

|

| Type of investments |

|

| Withdrawals |

|

-

TFSA vs RRSP?

-

Which makes more sense? With both, your investment growth is tax-sheltered, but there are important differences:

Product feature TFSAs RRSPs Annual contribution limit $6,500 for 2023 (plus unused contribution room) The lesser of $30,780 (for 2023) or 18% of earned income from your previous tax year, minus any pension adjustments, plus unused contribution room from previous years (increased annually) Tax-deductible contribution No Yes Contribution carry-forward Yes Yes Taxable consequences No tax on growth and no tax on any withdrawals Withholding tax applies if withdrawn prior to RRIF; the amount withdrawn is added to taxable income Maximum age for contributions No Yes (71 years old) Re-contribution of withdrawals Yes (in subsequent calendar year) No (except for Home Buyers’ Plan and Life Long Learning Plan) Overcontribution penalty Yes, 1% per month on over-contribution amounts (even if contribution was withdrawn subsequently in the same tax year) Yes, 1% per month if you exceed the $2,000 lifetime over-contribution amount Basically RRSPs save you taxes now and TFSAs save you taxes later.

TFSA

RRSP

Pre-tax income

$1,000

$1,000

Income tax paid (at 40%)

$434

n/a

Amount invested

$566

$1,000

Value after 20 years (assuming 5.5% growth)

$1,502

$2,653

Tax due when the money is withdrawn (at 40%)

$0

$1,152

Cash in hand after 20 years

$1,502

$1,502

Source: AGF Investments Inc. For illustrative purposes only.

-

-

TFSA vs non-registered savings

-

In both accounts, contributions are made with after tax money. However, in a TFSA, any earned interest, capital gains or dividend income remains tax free – but in a non-registered account, any earned income incurs taxes each year.

Product Features TFSAs Cash Accounts Annual contribution limit $6,500 for 2023 (plus unused contribution room) No limits Contribution carry-forward Yes N/A Taxable consequences No tax growth and no tax on withdrawals Fully taxable earnings growth Capital loss on Investment Cannot claim Can offset capital gains (three preceding tax years, carried forward indefinitely) Re-contribution of withdrawals Yes (in subsequent calendar year) Yes Overcontribution penalty Yes, 1% per month on over-contribution amounts (even if contribution was withdrawn subsequently in same tax year) N/A Why bother with a TFSA – because tax-sheltered growth can add up

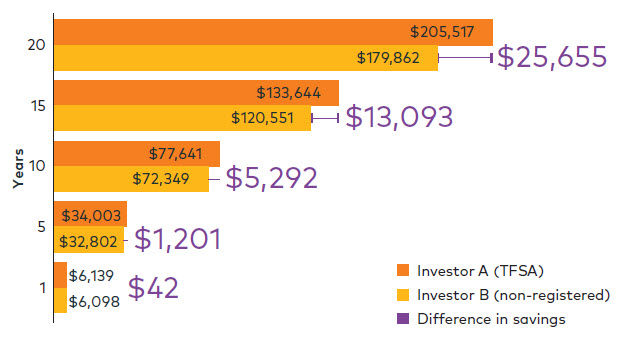

For example, let’s say you decide to set aside $500 a month. Maybe you want to save for a dream vacation. Or a new car. Or to renovate your kitchen.

Does it really make a difference if you put the money into a tax-sheltered plan, such as a TFSA, which can be used for any financial goal?

The chart below shows the same amount of money ($500/month) being invested in the same product (a hypothetical investment with a 5% annual return).

The only difference: Investor A chose a TFSA account, while Investor B chose a non-registered account. After one year, the amount may not seem significant but it makes a big difference over a longer time period.

Source: AGF Investments Inc. Performance returns presented are hypothetical and for illustrative purposes only. It does not represent actual performance. Assumptions were made in the calculation of these returns including $500 invested at the beginning of each month in a hypothetical investment with a rate of return of 5%. Of the 5% return, distribution yield of 2.0% (distribution composed of 50% interest and 50% capital gain). Interest taxed in the year received, while unrealized capital gains were taxed at the end of the holding period. Marginal tax rate of 50% for interest and 25% for capital gains, distributions reinvested. Taxes paid from out of pocket (not from sale of shares). Trading costs and other fees associated with the portfolios are not included and trading prices and frequency implicit in the hypothetical performance may differ from what may have actually been realized at the time given prevailing market conditions. This performance simulation is for illustrative purposes only and does not reflect actual past performance nor does it guarantee future performance.

-

-

TFSA Withdrawals

-

You can withdraw your savings tax-free at any time and for any purpose.

Since TFSA withdrawals are not considered income for tax purposes, there is no impact on government benefits – and your TFSA will not affect your eligibility to receive benefits such as the Guaranteed Income Supplement or Old Age Security benefits.

So if you’re saving for retirement, a TFSA can help manage your taxable income since withdrawals from an RRSP or RRIF are fully taxable.

Death of a registered plan holder†

- A subsequent increase in the value of the TFSA investments is generally included in the income of the beneficiaries of the TFSA upon distribution

- Exception – a "qualifying survivor" such as a spouse or common-law partner is the sole beneficiary of the TFSA . If the following two conditions are met, the deceased annuitant is not considered to have received the fair market value (FMV) of the TFSA at the time of death:

- The spouse or common-law partner is named in the TFSA contract as the sole beneficiary of the TFSA; and

- By December 31 of the year following the year of death, all the TFSA property is directly transferred to a TFSA under which the spouse or common-law partner is the annuitant (or to an issuer to buy an eligible annuity for the spouse or common law partner).

† Please note: Investors should seek professional advice on estate planning. The information on this website is by no means exhaustive or to be used instead of professional tax advice.

-

AGF Resources

RO 2706242