Not the First Bear Market, Not the Last

Strategy Spotlight: Why Managing the Downside is Critical

5 min readNot the First Bear Market, Not the Last

The S&P 500 index dropped close to 35% in a month earlier this year, representing one of the most violent selloffs in U.S. equities since the Great Depression. While stock markets have rallied since that time, they remain well below all-time highs that were established just prior to the downturn taking hold.

Bear markets of this magnitude are unnerving but are not uncommon. There have now been 12 corrections of 20% or more in the past 90 years, according to Cornerstone Research. This includes the market crash of 1929, Black Monday in the fall of 1987, and, more recently, the Tech Wreck of the early 2000s and the Great Financial Crisis in 2008-09.

In all 11 instances prior to this year, market losses from these corrections were fully recouped after an average period of 79 months or just over six and a half years. But individual recovery times were largely dependent on the magnitude and duration of the pullback, with the biggest drawdowns resulting in the longest recoveries.

Less is Often More

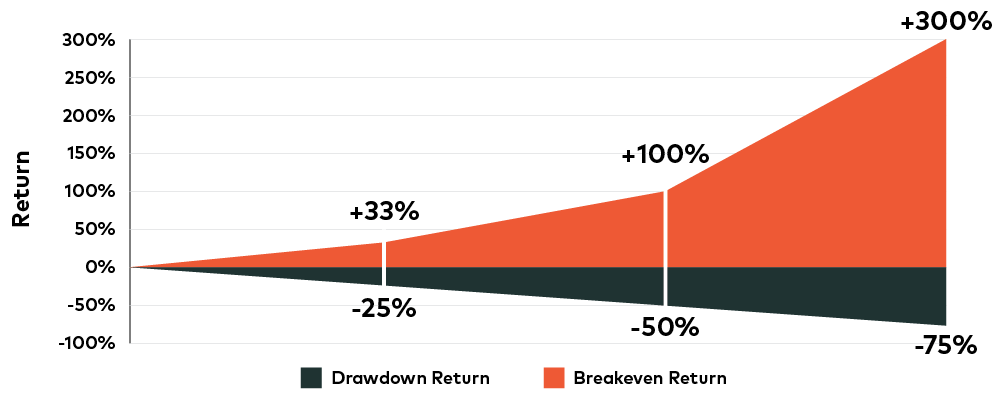

Reducing drawdowns can help to preserve wealth, dampen volatility and reduce the time and return needed to fully recoup losses. But attempting to time the market to achieve these goals may end up doing more harm than good.

While tactical adjustments including larger allocations to cash may help minimize losses during a correction, it is important that investors maintain a well-diversified portfolio through all phases of a full market cycle. This includes strategic weightings to stocks and bonds, as well as other non-correlated asset classes and/or long-short liquid alternative strategies that can help mitigate downside risks even further when they arise.

It can take longer than expected to earn back losses.

Why AGFiQ US Market Neutral Anti-Beta CAD-Hedged ETF (QBTL)?

The strategy’s market neutral structure invests long in U.S. stocks that have below-average betas and shorts U.S. stocks that have above-average betas, within sectors. While there are market circumstances under which the strategy may provide positive returns when broader equity markets are rising, it is designed specifically as an equity hedge to gain when stocks fall – as was the case recently. This makes the strategy well-suited to be a long-term strategic holding as well as short-term tactic that helps investors manage through the ebb and flow of unpredictable markets.

Commissions, management fees and expenses all may be associated with investing in AGFiQ ETFs. Please read the relevant prospectus or relevant ETF Facts before investing. Exchange-traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. There is no guarantee that AGFiQ ETFs will achieve their stated objectives and there is risk involved in investing in the ETFs. The risks associated with each AGFiQ ETF are detailed in the prospectus. Before investing you should carefully consider each ETF’s investment objectives, risks, charges and expenses. This and other information is in the ETF’s prospectus. Please read the prospectus carefully before you invest. A copy is available on AGFiQ.com

The commentaries contained herein are provided as a general source of information based on information available as of June 5, 2020 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication however, accuracy cannot be guaranteed. Investors are expected to obtain professional investment advice.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), Highstreet Asset Management Inc. (Highstreet), AGF Investments LLC (formerly FFCM, LLC), AGF Investments America Inc. (AGFA), AGF Asset Management (Asia) Limited (AGF AM Asia) and AGF International Advisors Company Limited (AGFIA). AGFA is a registered advisor in the U.S. AGFI and Highstreet are registered as portfolio managers across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF AM Asia is registered as a portfolio manager in Singapore. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

™ The ‘AGF’ logo is a trademark of AGF Management Limited and used under licence.

Managing the Downside

Try our interactive tool to see how an alternative strategy could help provide a smoother ride.

Try it nowExpert Commentary on News, Investing, Markets and Finance from AGF's Leading Financial Minds

Subscribe Now