A Diversified Approach to Emerging Markets

By: AGF Investments • October 15, 2018

Investors have traditionally looked to emerging markets as a way to further diversify their global portfolios. Over the past few years, many have begun to shy away from this growing region based on intermittent volatility.

With

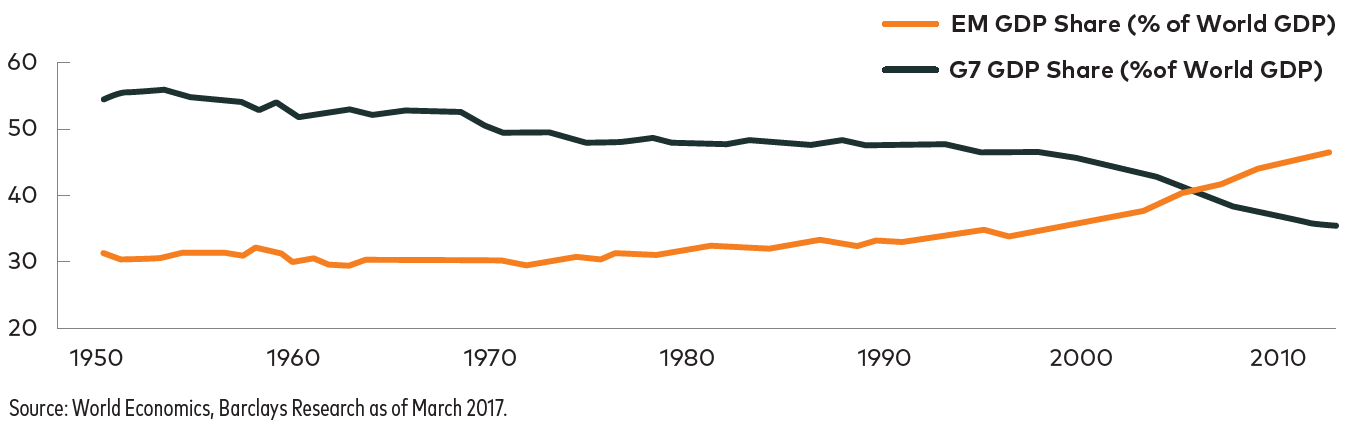

1 | EM: A Driver of Global Economic Growth

One of the major market “winners” of the recent hyper-globalization has been emerging markets.For the first time in 50 years, we begin to see emerging markets gaining a greater share of global GDP.

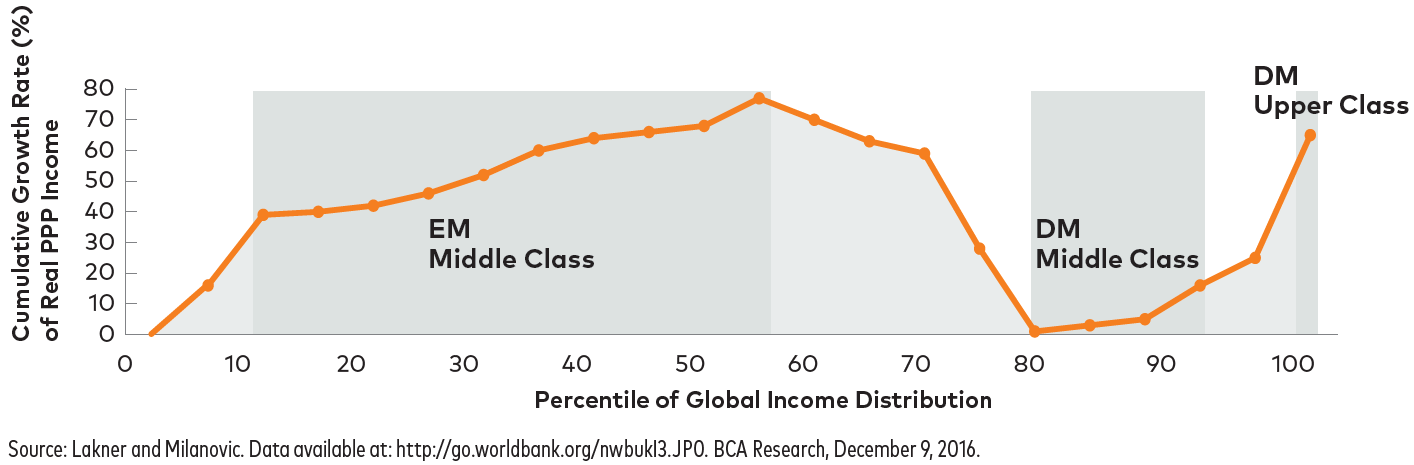

2 | Wages: A Story of Growth and Increased Distribution

The emerging market middle class has shown greater wage growth in the middle class than that of both the middle and upper class of developed markets. This provides a compelling backdrop for continued innovation and investment opportunity in sectors driven by consumer demand.Real Income Over 20 Years, Cumulative Change

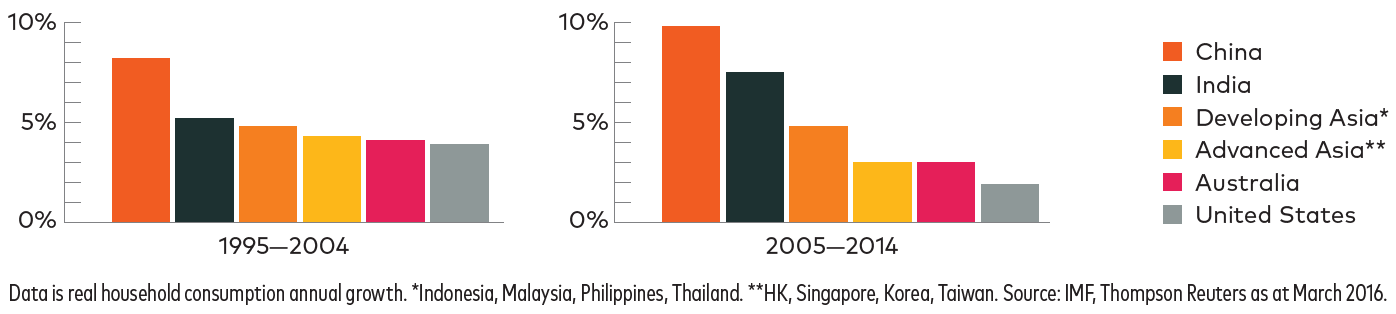

3 | Emerging Consumer Driven Economies

In fact, in the past 10Over Decade - Annual Consumption Growth

Over 5- and 10-year periods, concentrated portfolios have been able to generate greater alpha than more diversified portfolios, without significantly increasing risk:

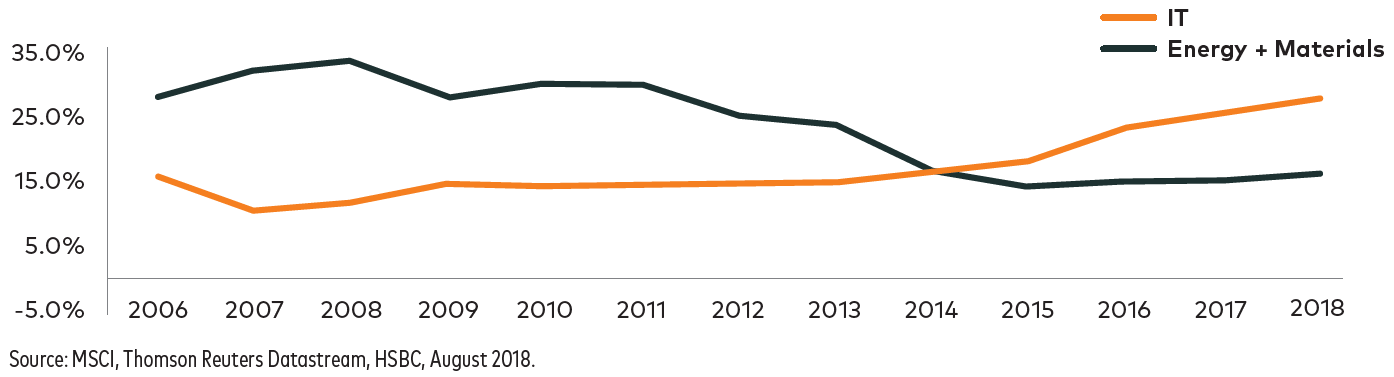

4 | A Tech Revolution is Well Underway

That shift towards the technological innovation has caused a reorientation of the sector weights within the emerging markets major benchmark, MSCI EM Index. For the first time in over 10 years, the information technology sector has surpassed energy and materials.

By adding a more concentrated portfolio to an already diversified core, you increase the potential for greater returns without significantly increasing risk.

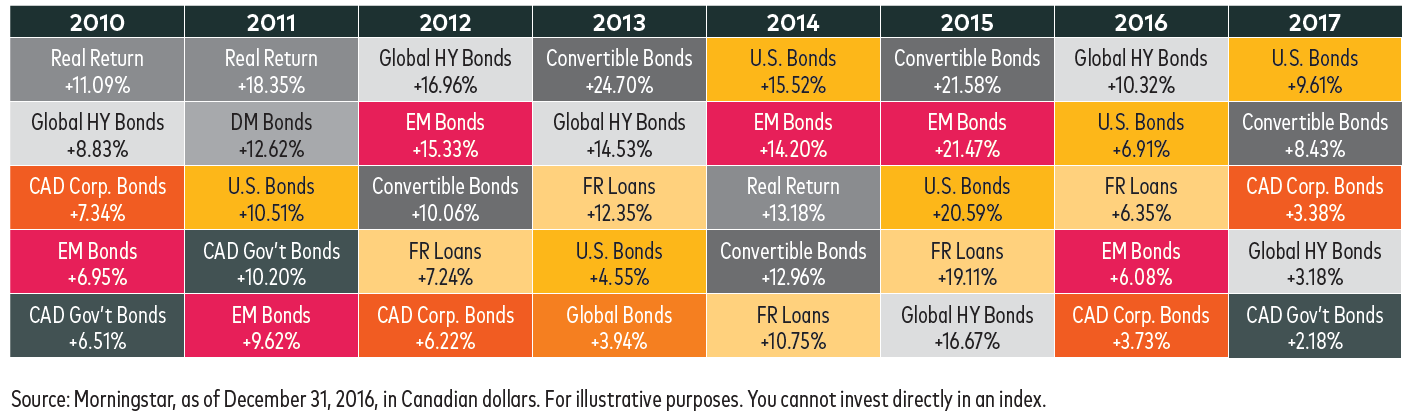

5 | EM Bonds: Delivering Diversification and a Greater Potential for Capital Appreciation

What we begin to see is the emergence of investment opportunities in the emerging markets both in equity and fixed income. Emerging market bonds have the potential to provide greater diversification for fixed income portfolios while also generating a greater potential for capital appreciation.

AGF offers a full suite of solutions, providing the ability for investors to access emerging markets at the level they feel most comfortable with:

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The All World Tax Advantage Group is a mutual fund corporation that currently offers approximately 20 different classes of securities. In addition, to fund diversification by investment style, geography and market capitalization, a key benefit of investing in any of the classes within the group is the possibility of sharing incurred expenses (and losses) of the combined structure potentially offsetting income earnings to minimize the chance of a dividend declaration. For a more detailed the explanation, please see AGF.com/disclaimers.

AGFiQ ETFs are ETFs offered by AGF Investments Inc. and managed by Highstreet Asset Management Inc. AGFiQ ETFs are listed and traded on organized Canadian exchanges and may only be bought and sold through licensed dealers.

©2018 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the confidential and proprietary information of Morningstar, (2) may include, or be derived from, account information provided by your financial advisor which cannot be verified by Morningstar, (3) may not be copied or redistributed, (4) do not constitute investment advice offered by Morningstar, (5) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (6) are not warranted to be correct, complete or accurate. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. This report is supplemental sales literature. If applicable it must be preceded or accompanied by a prospectus, or equivalent, and disclosure statement.

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

The All World Tax Advantage Group is a mutual fund corporation that currently offers approximately 20 different classes of securities. In addition, to fund diversification by investment style, geography and market capitalization, a key benefit of investing in any of the classes within the group is the possibility of sharing incurred expenses (and losses) of the combined structure potentially offsetting income earnings to minimize the chance of a dividend declaration. For a more detailed the explanation, please see AGF.com/disclaimers.

AGFiQ ETFs are ETFs offered by AGF Investments Inc. and managed by Highstreet Asset Management Inc. AGFiQ ETFs are listed and traded on organized Canadian exchanges and may only be bought and sold through licensed dealers.

©2018 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the confidential and proprietary information of Morningstar, (2) may include, or be derived from, account information provided by your financial advisor which cannot be verified by Morningstar, (3) may not be copied or redistributed, (4) do not constitute investment advice offered by Morningstar, (5) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (6) are not warranted to be correct, complete or accurate. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. This report is supplemental sales literature. If applicable it must be preceded or accompanied by a prospectus, or equivalent, and disclosure statement.

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).