Why go global

Canada's role on the world stage

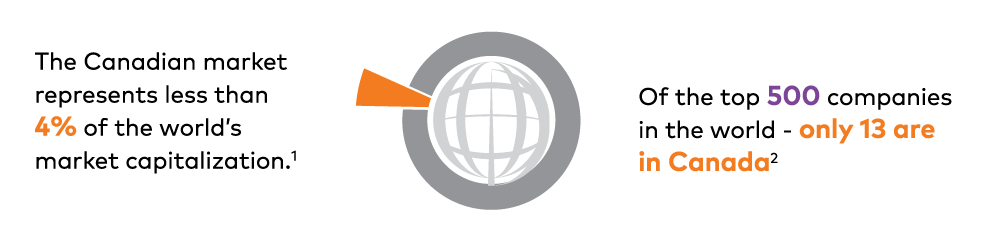

1 Source: AGF Investment Operations. MSCI (Developed) World Index, as at December 31, 2019.

2 Fortune Global 500 (companies ranked by revenue as at March 31, 2019, fortune.com/global500).

MSCI World is used as a proxy for the “Rest of the World” as Canada represents only 3.4% of the Index.

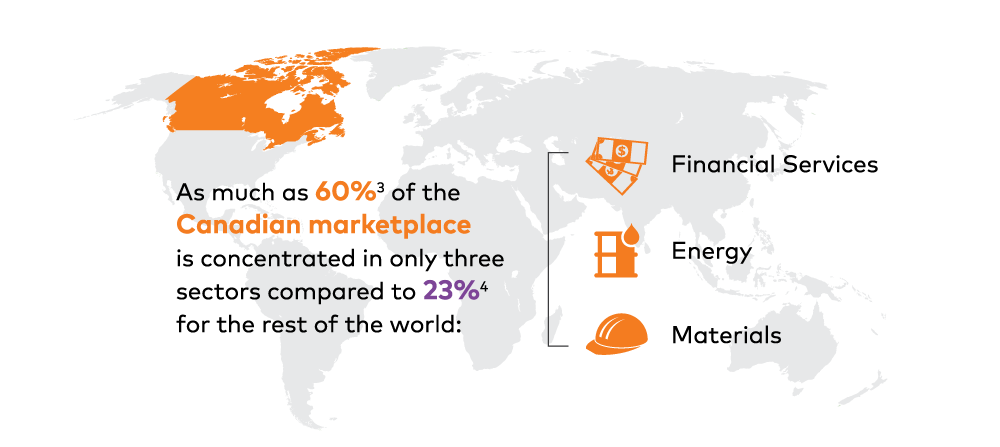

3 Source: AGF Investment Operations. S&P/TSX Composite Total Return Index, as at December 31, 2019.

4 Source: AGF Investment Operations. MSCI (Developed) World Index, as at December 31, 2019.

MSCI World is used as a proxy for the “Rest of the World” as Canada represents only 3.4% of the Index.

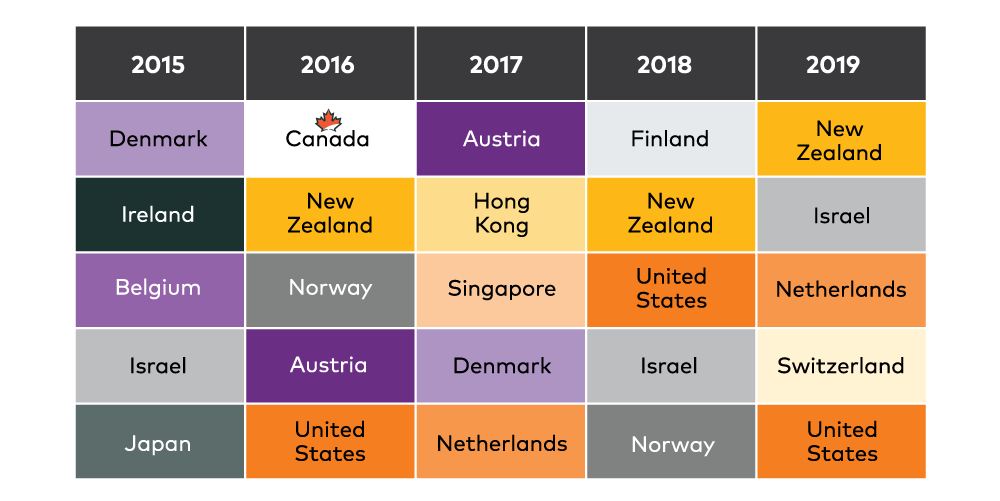

Diversification across various countries can be an optimal way to reduce risk and improve overall performance

Elements that drive the performance of one market may not for another. In Canada’s case, market performance is closely tied to the resource sector, which has historically had cyclical performance.

Source: AGF Investment Inc., Bloomberg – top-performing countries 2015-2019 on a calendar-year basis as determined by the regional contribution to the performance of the MSCI All Country World Index. As of December 31, 2019.

Discover more about global investing here and talk to your financial advisor about how this investing strategy fits with your financial portfolio.

The commentaries contained herein are provided as a general source of information and should not be considered personal investment or tax advice. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or reliance on the information contained here.

The contents of this Web site are provided for informational and educational purposes, and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. Please consult with your own professional advisor on your particular circumstances.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

TM The ‘AGF’ logo and ® ‘Sound Choices’ are registered trademarks of AGF Management Limited and used under licence.