How to Trade AGF ETFs

How to trade AGF ETFs

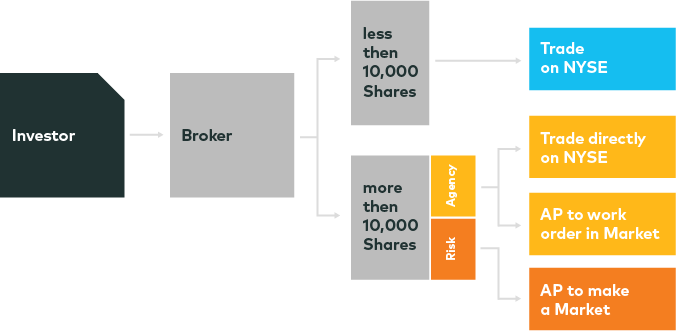

Institutional investors, RIAs, financial advisors and anyone else trading an ETF that is composed of liquid underlying securities can find immediate liquidity and execution for large trades in that ETF at very low cost, regardless of the ETF's trading volume and bid/ask quote depth. Unlike a regular equity security in which there is a somewhat fixed number of shares outstanding, ETFs can create new shares and therefore additional liquidity as frequently as necessary. Institutional traders called "Authorized Participants" (APs) use the creation and redemption process to bolster ETF volume and satisfy market demand. Liquid portfolios make it easier for an AP to cover the cost of creating additional shares of the ETF, thus facilitating low cost execution. The more liquid the underlying securities are, the easier and cheaper it is for an AP to create more shares and meet demand. The APs will buy the underlying positions and deliver these securities to the fund's custodian in exchange for shares of the ETF that they can turn around and sell to their clients. This process reinforces that printed volume does not represent true market liquidity and, in fact, can actually be a very misleading indicator of an ETF's liquidity and in turn the true cost of trading.

Clients who have larger orders above 10,000 shares can place a direct (principal trade) with a broker at a pre-negotiated price close to NAV. The broker that a client can trade with is either also an AP or has direct access to an AP desk, which will be able to execute the trade directly. Sourcing liquidity through a principal trade with a sell-side counterparty minimizes market risk and also helps the client to establish a price prior to execution.

Source: Seeking Alpha Nov.15, 2011

AGF Authorized Participants

- Barclays

- Citi

- Credit Suisse

- Deutsche Bank

- Goldman Sachs

- JP Morgan

- Knight Trading

- Morgan Stanley

- Nomura

- UBS

AGF Trading Contact

Risks: There is no guarantee that the Funds will achieve their objective. An investment in the Funds is subject to risk including the possible loss of principal amount invested. The risks associated with each Fund are detailed in the prospectus and include, but not limited to, tracking error risk, mid-cap risk, industry concentration risk, market neutral style risk, short sale risk and specific risks related to exchange traded funds. There is a risk that during a “bull” market, when most equity securities and long only ETFs are increasing in value, the Funds’ short positions will likely cause the Fund to underperform the overall U.S. equity market and such ETFs. The Fund may not be suitable for all investors.

AGF U.S. Market Neutral Anti-Beta Fund (“BTAL”) performance may deviate from the Dow Jones U.S. Thematic Market Neutral Low Beta Index (the “Index”) performance and should not be expected to track (or perform in tandem to) the Index in all market conditions. From its inception on September 12, 2011 through February 13, 2022, BTAL’s investment objective was to track the Index. Effective February 14, 2022, BTAL changed from a passive index-tracking strategy to an active, rules-based strategy that seeks to provide a consistent negative beta exposure to the U.S. equity market. Performance prior to February 14, 2022 would have been different had the current investment objectives been in effect.

AGF Global Infrastructure ETF (GLIF) specific risks: The Fund’s investments in infrastructure-related securities will expose the Fund to potential adverse economic, regulatory, political, legal and other changes affecting such investments. Rising interest rates could lead to higher financing costs and reduced earnings for infrastructure companies. Investments in foreign securities involve risks that differ from investments in securities of U.S. issuers because of unique political, economic and market conditions. Investments in securities of issuers located in emerging market economies (including frontier market economies) are generally riskier than investments in securities of issuers from more developed economies. Investing in securities that trade in and receive revenues in foreign currencies creates risk because foreign currencies may decline relative to the U.S. dollar, resulting in a potential loss to the Fund.

Shares are not individually redeemable and can be redeemed only in Creation Units. The market price of shares can be at, below or above the NAV. Brokerage commissions will reduce returns. Market Price returns are determined based on the midpoint of the bid/ask spread calculated based on a price within the range of the highest bid and lowest offer on the principal U.S. market on which the Fund’s shares are traded during a regular trading session. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable.

Distributor: Foreside Fund Services, LLC

This website should not be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. Nothing on this website is intended to be investment, tax, financial or legal advice.