AGF GLOBAL SUSTAINABLE GROWTH EQUITY STRATEGY

Subthemes of Sustainable Investing: Sustainable Food and Aquaculture

Download (PDF 3,829KB) 5 min readThe Opportunity

Reducing the negative environmental impact of food has emerged in recent years as one of the most critical factors determining our future well being. By some estimates, what we eat and how it’s produced accounts for over a quarter of greenhouse gas emissions globally1 and lies at the heart of several other degradations to the natural environment including those related to land and freshwater use, eutrophication and biodiversity.

But like many problems worth fixing, the desire to create a healthier, more sustainable food supply is a process that can lead to new opportunities for investors over time.

Perhaps nowhere is this more evident than it is within the multi-billion-dollar aquaculture industry that continues to innovate with a goal to reduce its front-running environmental footprint even further over the long term, while still capitalizing on the growing demand of its end products.

Seafood—and fish in particular-- has long held the advantage of being a “super food” rich in nutrients linked to a range of heath benefits and it is now widely accepted as a better dietary choice to beef, pork and poultry, the trinity of agricultural livestock production. In fact, demand for fish protein has been on the rise for the past few decades primarily because of the structural transition towards healthier diets and, thanks to rising per capita consumption in developing countries as well, now represents approximately 16% of global protein consumption2.

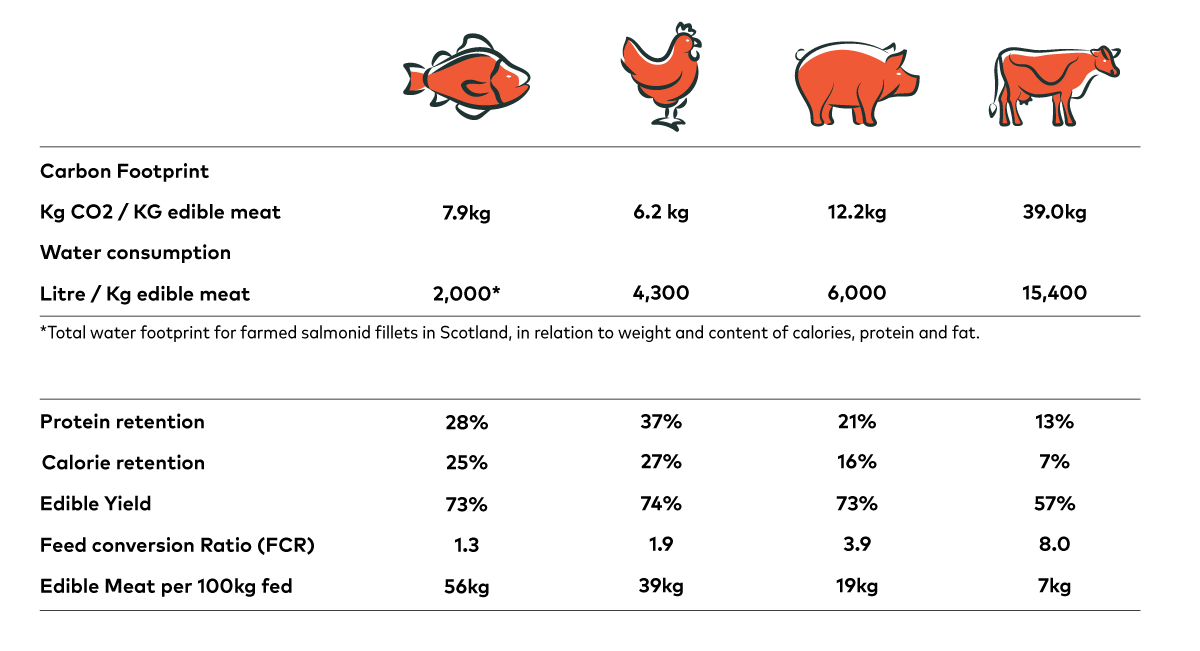

But what may be somewhat less understood is the fact that fish protein that is farmed tends to be “friendlier” to the environment than agricultural sources of animal protein- especially when taking into consideration some of the beneficial production traits associated with it. These benefits include a lower threshold of water consumption and lower overall carbon footprint, as well as a better feed conversion ratio and higher edible meat per feed fed (see Figure 1).

Figure 1

But that’s not all. Aquaculture – the breeding, raising, and harvesting of fish - is also considered a remedy of choice for other environmental ills such as overfishing and the resultant depletion of the wild fish population. As it stands, wild fishing accounts for about half of the global seafood supply, but its share of the total has dropped significantly in recent years and is only expected to fall as more action is taken against overfishing to rectify related concerns such as the growing decline in both the ocean’s volume and overall biodiversity, as well as warming global temperatures that are driving further increases in fish migration.

The World Bank, for example, has recommended that wild fishing needs to be reduced by at least 5% annually over the next decade so that wild fish populations can recover to sustainable levels. Meanwhile, The Ocean Panel, formed in 2020 by 14 countries including Japan, Norway, Canada, Chile, and Indonesia, has made its own commitment to restore and harvest the wild fish stock in oceans at sustainable levels by 2030.

Culture over Capture: The Ongoing Evolution of Fish Farming

As mentioned, fish is now sourced almost evenly between wild catch that is found in natural water bodies (capture fish) and fish that is farmed in a more controlled environment (culture fish). However, given the sustainability constraints impacting the former, the tide is clearly in the latter’s favour to become the predominant supplier of fish as global demand for both continues to grow.

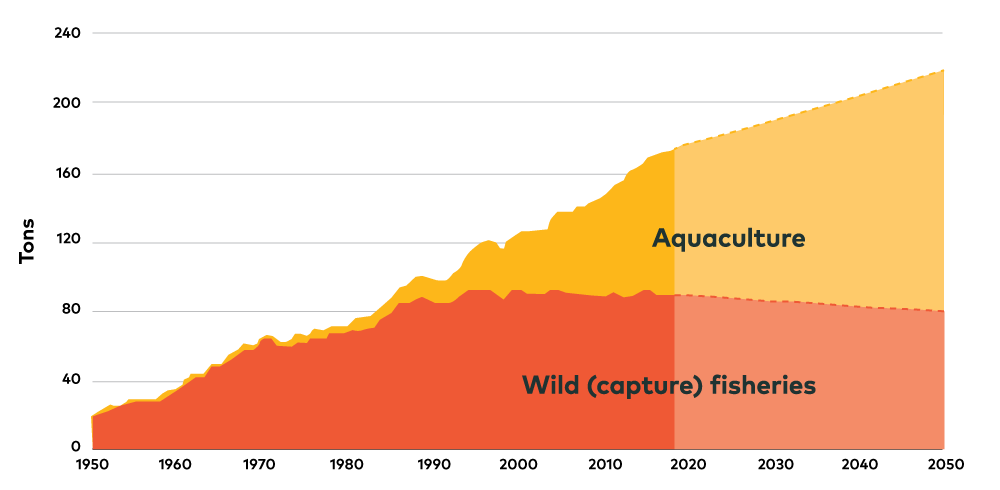

Among other things, this should result in a significant increase in the amount of farmed fish consumed globally. Indeed, by some estimates, the amount is expected to grow by 50% over the next 20 years (see Figure 2). But it may also lead to a broadening out of the aquaculture industry, which today remains highly consolidated with 89% of the roughly 82 million tonnes of culture fish consumed annually (Approximate value of US$250-billion) being accounted for by the top-three aquaculture-producing countries in the world.

Figure 2

Still, the aquaculture industry isn’t without challenges, nor is it beyond reproach. It, too, has sustainability deficiencies that threaten to undermine its growth potential if left unchecked.

For starters, in some unregulated markets, fish farms have resulted in clearcutting of mangrove trees, leading to loss of biodiversity in surrounding areas. The industry must also deal with concerns around excessive use of antibiotics for fish health and the sustainability of fish feed, which is heavily dependent on capture fish.

Moreover, there’s the issue of fish effluents, which can lead to water pollution and the disturbance of fragile ecosystems. And then there is the difficulty of fish escapement that typically occurs due to structural damages to fishnet pens from weather, ocean conditions, and other failures. In this case, not only do farmed fish that escape impact ocean biodiversity by competing for natural resources with wild species, they also impact it by inter-breeding with wild species, which genetically alters the native population and reduces their ability to adapt.

Without doubt, these are serious problems, but the aquaculture industry to its credit continues to show a willingness to mitigate these risks and others that are of equal concern through new techniques and technologies that can limit their negative impact.

Salmon farming, to that end, may be the perfect example of how ingenuity can help solve for more than one problem. While only representing about 3% of global fish consumption, it has emerged over the past few decades as one the most advanced and investment-ready forms of fish farming in the world.

In large part, that success is rooted in the salmon farming industry’s commitment to animal health as well as its bent towards innovative fish breeding techniques, technologies and infrastructure that are needed to help overcome persistent supply constraints while at the same time also tackling many of the sustainability concerns faced by the industry.

As an example, most Atlantic salmon farming is currently done using fishnet pens that are set up in open natural water bodies. However, without some new innovative fix, it’s hard to replicate this approach in warmer parts of the world given salmon’s natural propensity to thrive in colder water temperatures between 12 and 14 degrees Celsius.

Similarly, the industry continues to grapple with the problem of sea lice, a major disease which often results in significant losses from the gutted weight of fish harvested.

So, what exactly are these “fixes”? Two options that promise to address—at least in part3—the environmental challenges facing the salmon farming industry, while also driving future supply growth higher include land-based re-circulation systems and further advances in offshore marine salmon farming.

Land-based re-circulation systems

Of these two options, the former is easily the most novel approach to more traditional salmon farming where fish being farmed typically stay in land-based tanks for about 18 months before being transitioned to a marine environment where they remain until harvest.

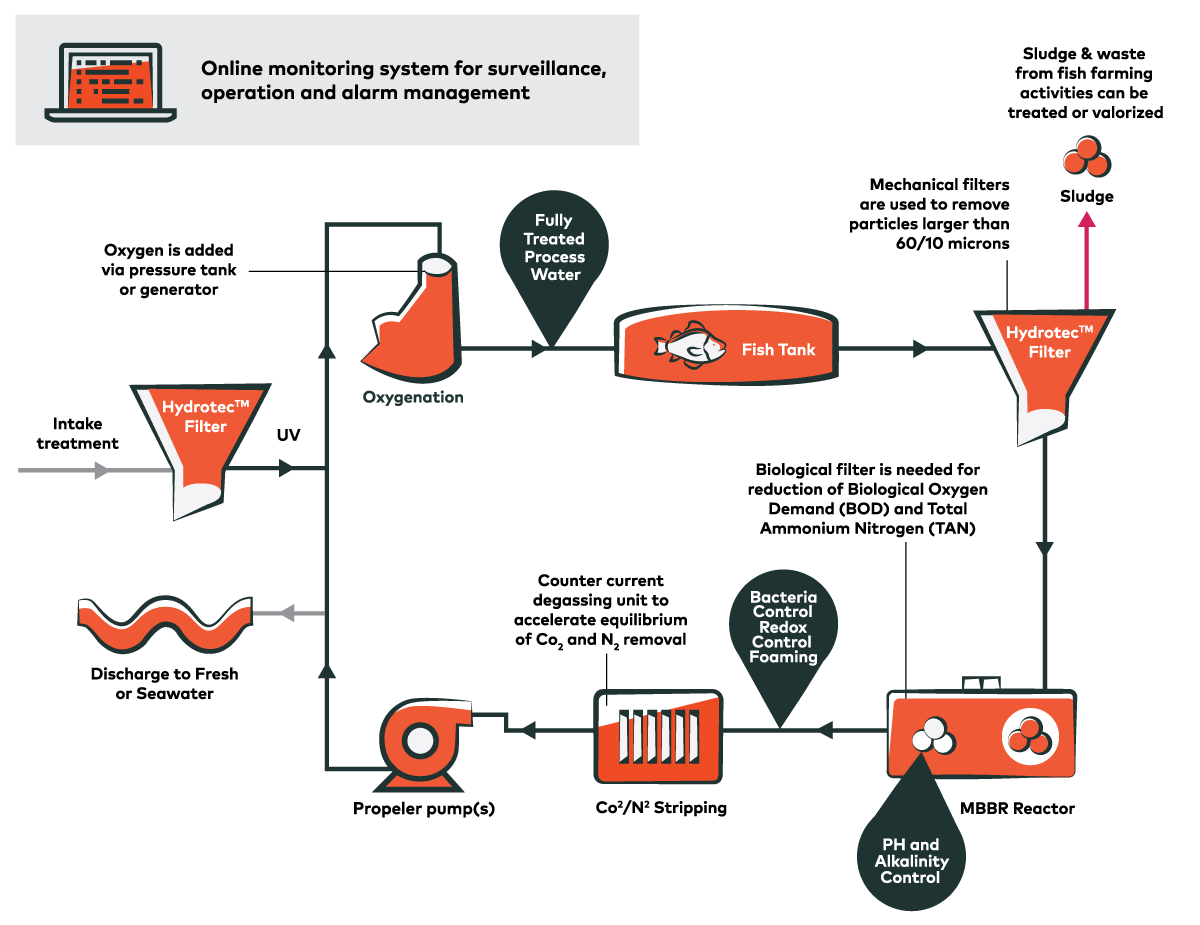

In land-based systems, salmon live their entire life in onshore fish tanks by employing flow-through technologies that filter, treat and recirculate water to mitigate problems often associated with fish tanks such as fish waste, water pollution, hydrogen sulphide poisoning and crowding.

These tanks are also constantly monitored for parameters such as oxygen, carbon dioxide, and ammonia, which, in turn, produces healthier and higher quality fish. Furthermore, given the controlled environment used for onshore fish farming, many land-based farmers claim the use of antibiotics or pesticides for disease management to be unnecessary.

In contrast to these benefits, land-based systems can be more energy intensive than traditional offshore salmon farming due to the extensive operations of water recirculation units, cooling and ventilation systems. That said, there is still an expected net environmental benefit when considering onshore farms being closer to end markets. After all, with 90% of salmon consumed fresh (and 10% frozen) the logistics of marine salmon supply chain is highly dependent on the emissions-intensive air freight industry.

Recirculation aquaculture system

Offshore marine salmon farming

Short of the advantages associated with land-based systems, improvements in the supply and sustainability profile of culture fish will largely be tied to new techniques in offshore farming in the coming years. One key path to overall sustainability profile improvement is the adoption of plant, algae or insect-based alternatives to current fish feed options that are too reliant on wild fish for fish oil and fishmeal ingredients. Fish breeding and genetics is also an important step towards improving growth rates, feed conversion efficiencies, and other health and quality metrics. In particular, we believe that genomic selection and selective breeding will play a crucial role in reducing the use of antimicrobials in the future.

Analyzing the Value Chain

Given all of this—from the growing demand to the steadfast commitment to remove supply constraints and limit environmental harm—there are several ways that investors can participate in the opportunities being generated from the salmon industry. Here’s six categories along the value chain to consider:

Salmon producers: The incursion of land-based systems is expected to bridge supply gaps and democratize the production of salmon as long-term demand for it continues to outpace global GDP growth and translate into higher prices over time. That said, land-based opportunities have not been completely de-risked and therefore could be fraught with execution risk such as equipment failures as is typical with early-days technologies.

Sustainable fish feed producers: Innovative companies working on producing plant, algae and insect-based feed alternatives to reduce the reliance on capture fish are set to benefit from the overarching transition towards more sustainable protein consumption and grow their stake in a market that represents 40-50% of the product cost of a typical aquaculture farm. Production scale, however, will be a key hurdle to the full adoption of alternative feed in the coming years.

Production technology & equipment suppliers: As the seafood industry transitions more towards fish farming, aquaculture systems will eventually replace fishing assets. In turn, uptake in demand for water recirculation systems, underwater monitoring technologies, and hatcheries should be expected to grow with the emergence of land-based systems, in particular.

Fish health: Fish vaccines and treatments for diseases such as sea lice represent one of the fastest growing segments of the animal health industry and may have more runway to grow given the move to ban the use of antibiotics across the industry.

Fish waste management: In land-based systems, advanced filtration systems are deployed to remove fish effluents from fish tanks. In addition, biomass from fish processing is collected and could form the basis of useful products like fertilizer and biofuels. As a result, opportunities for fish waste management and waste-to-fuel companies are growing.

Fish breeding & genetics suppliers: The focus on yield and alternative options to combating antimicrobial resistance should create upside opportunities for businesses focused on breeding or genetically creating elite fish eggs that are resistant to certain pathogens.

What About Plant-Based Fish Protein?

The plant-based seafood market is nascent today, particularly when compared with the plant-based meat segment which has received greater capital deployment and overall media attention. However, there are several start-up companies innovating in this area as they work towards delivering the same taste, texture, quality and nutrition as fish.

Like plant-based meat, the main source of protein is typically any one of pea, lentil, soy and wheat with combinations and additional ingredients critical for delivering on taste and nutrition. But unlike plant-based protein, where carbon reduction is a primary objective, the environmental advantages of plant-based fish technology relates more to the maintenance of natural ecosystems than it does carbon reduction that nonetheless remains a secondary benefit.

We believe that we will see greater focus on this category, particularly as regulators begin to move their focus from climate change to areas such as biodiversity and ecosystem integrity, which is already a discussion point within the European Union.

Conclusion

In our view, the desire to clean up the world’s natural environment has become a top priority for investors in recent years, but it is only the actions they take going forward that will make a real difference. To that end, aquaculture may not be a panacea for all that ails the global food industry, however, it no less represents one of the best avenues for ensuring healthier, more sustainable diets in the future and offers a unique set of investment opportunities across its supply chain. While selectively remains key, the combination of rising global demand and technological innovation to overcome both supply and sustainability constraints is likely to result in growing investment opportunities over time.

1 Article: Reducing food’s environmental impacts through producers and consumers. Published in Science, Volume 360, Issue 6392, June 2018.

2 Source: U.N. Food and Agriculture Organization (FAO).

3 These two options present opportunities to address some of the challenges highlighted, however with offshore salmon farming, sea lice concerns are only partially mitigated and broader issues such as fish escapement and biodiversity impact are largely unmitigated.

The commentaries contained herein are provided as a general source of information based on information available as of April 30, 2021 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication however, accuracy cannot be guaranteed. Market conditions may change and the Portfolio Manager accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Investors are expected to obtain professional investment advice.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA)and AGF International Advisors Company Limited (AGFIA).

AGFA is a registered advisor in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

The “AGF” logo and “Invested in Discipline” are registered trademarks of AGF Management Limited and used under licence.

Publication date: May 14th, 2021