FHSA

Saving for Your First Home

The First Home Savings Account (FHSA) is a new registered plan that will allow investors to save on a tax-free basis for their first homes.

FHSA Fast Facts (PDF 370KB)

Key Reasons to Invest in an FHSA

- Contributions are tax deductible

- Withdrawals to purchase a first home, including investment income and growth, are non-taxable

- Funds from an FHSA and the Home Buyers’ Plan (HBP) can be combined – $75,000 in capital for a down payment, plus any growth in the FHSA

- Remaining amount can be transferred to an RRSP or RRIF penalty-free and tax-deferred with no impact to RRSP contribution limit

Who is Eligible

To open an FHSA, you must be:

- An individual resident of Canada

- At least 18 * up to age 71

- A first-time home buyer, which means you, or your spouse or common-law partner ("spouse") ** did not own a qualifying home that you lived in as a principal place of residence at any time in the year the account is opened or the preceding four calendar years ***

*Or the age of majority in your province or territory.

**For the purposes of the first-time home buyer's test, a home owned by your spouse in which you lived during the relevant period will only put you offside of the test if that person is still your spouse when the FHSA is opened.

***The principal residence in the current year or preceding four years need not be in Canada. An immigrant to Canada may have to wait five years if they sold their principal residence before coming to Canada.

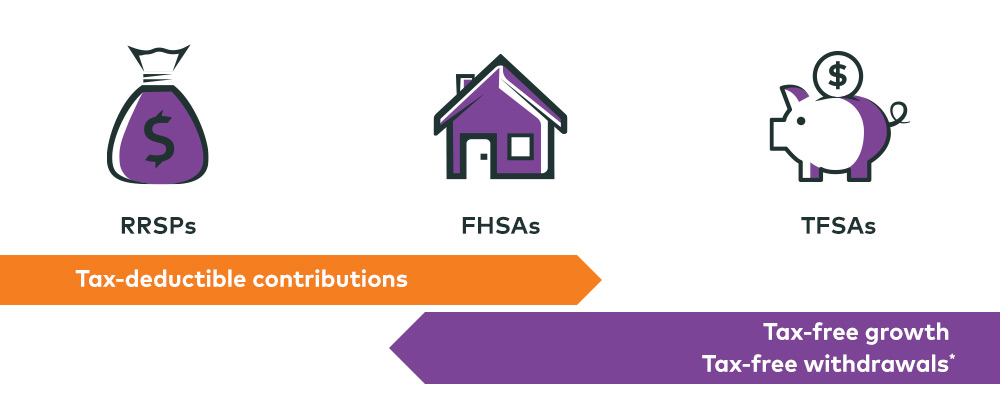

Similarities with RRSPs and TFSAs

* Qualifying withdrawals only.

FAQs about the FHSA

Here are answers to some of the questions we've been receiving

Forms

-

AGF FHSA Application Form

-

Request to Make a Qualifying Withdrawal from your FHSA

-

Transfer from your RRSP to your FHSA

-

Transfer from your FHSA to your FHSA, RRSP or RRIF

-

Transfer from an FHSA to another FHSA, RRSP or RRIF on Breakdown of Marriage or Common-law Partnership

-

AGF Transfer Authorization for Registered Investments (TARI)

Registered Plans Guide

What you need to know about the registered plans that AGF offers

Contributions

Deadline

- December 31, 2023

- Contributions don’t have to be claimed for the tax year in which the contribution is made.

Limit

- First-time homebuyers can contribute up to $40,000 tax-free with an annual contribution limit of $8,000

- Investors will be allowed to contribute the full $8,000 annual limit in 2023, regardless of when the account is opened that year

- Multiple FHSA accounts can be opened by one person individually, but the combined contributions may not exceed the annual or lifetime contribution limits

If you and your spouse both qualify, you can each have an FHSA and combine the funds accumulated to buy a qualifying home together.

There isn't a spousal FHSA, but you can gift funds to your spouse (or child) for them to contribute to their own FHSA. (As the owner of the FHSA, they will also claim the tax deduction.)

Carryforward

- Contribution room starts accumulating once the FHSA has been opened. Carryforward amounts accumulate from the year after the year the FHSA was opened.

- Unused contribution room can be carried forward to the maximum annual limit of $8,000 – so contribution room is capped at $16,000

- For example, you open an FHSA in 2023 but don't contribute – in 2024, you can contribute $16,000

- If you don't contribute in 2023 or 2024, in 2025, you can still only contribute $16,000 (not ($24,000) – and then in 2026, you can contribute $8,000

- Meaning one year of contribution room is lost, but you still maintain the lifetime contribution limit of $40,000

Over-Contributions

- Penalty tax of 1% per month (or part month) on the highest amount of the excess in that month

- When the investor’s annual contribution limit resets at the beginning of each calendar year, the over-contributed amount is deducted from that year's contribution limit

- If you inadvertently made excess contributions, you could reduce penalties by:

- withdrawing the excess as a designated amount

- making a direct transfer of a designated amount to your RRSP or RRIF

- making a taxable withdrawal

Withdrawals

- Non-taxable if being used towards the purchase of a qualifying home and the investor still qualifies as a first-time home buyer when making the withdrawal

- Are not taken into account in determining eligibility for income-tested benefits or credits (for example, the Canada Child Benefit, GST Tax Credit)

Qualifying Homes:

- Include a single-property purchase of a housing unit (or share in a co-operative housing corporation) located in Canada

- Must have written agreement to buy or build a qualifying home before October 1st of the year following the withdrawal

- The property must be used as a principal residence - not a leisure property - and occupied within one year of acquisition

- Investors can make qualifying withdrawals within 30 days of moving into a qualifying home

Taxable Withdrawals:

- Would be subject to withholding tax and the amount withdrawn included in the investor's income for that year

- Examples:

- Investor is no longer a Canadian resident at the time of the withdrawal and/or when the qualifying home is bought or built

- Investor is no longer a first-time home buyer

- Withdrawal is not used for purchasing a qualifying home

- Money withdrawn to close an FHSA (and wasn't transferred tax-free to an RRSP or RRIF)

FHSA and HBP

FHSA and HBP

- Funds from an FHSA and Home Buyers’ Plan (HBP) can be used together for the same purpose – up to $75,000 in capital for a down payment, plus any growth in the FHSA

- Provides greater flexibility than HBP withdrawals which are required to be repaid (See "Two less-traditional ways to use RRSPs")

Tax Features

- Can defer and potentially lower the total amount of income tax payable

- You will receive a tax receipt and the amount can be claimed as a deduction to reduce taxable income

- NOTE: Contributions made to an FHSA following a qualifying withdrawal would not be tax-deductible

No Spousal Plans

- You can gift funds to your spouse for them to invest in their FHSA

- They will then claim the tax deduction

- Any investment growth will not be attributed back to you

- When the spouse withdraws the money from the FHSA, only the spouse will need to include the withdrawn amount in their income, if applicable

- NOTE: You can also provide funds to your child so they can contribute to their FHSA. The same attribution rules apply.

Qualifying Withdrawals

- Non-taxable

- Nottaken into account in determining eligibility for income-tested benefits or credits (for example, the Canada Child Benefit, GST Tax Credit)

Taxable Withdrawals

- Subject to withholding tax and the amount withdrawn included in the investor's income for that year

- Examples:

- Investor is no longer a Canadian resident at the time of the withdrawal and/or when the qualifying home is bought or built

- Investor is no longer a first-time home buyer

- Withdrawal is not used for purchasing a qualifying home

- Money withdrawn to close an FHSA (and wasn't transferred tax-free to an RRSP or RRIF)

- Funds can be transferred tax-free from an RRSP to an FHSA or from an FHSA to an RRSP with no impact to the investor's RRSP contribution room

How Long the Plan Can Stay Open

- The FHSA timeframe focuses on the individual and not the account.

- The clock starts ticking as soon as the account is opened.

- Maximum participation period for a qualifying individual (see "Who is Eligible" above) ends at the earliest of the following events:

- The end of the 15th year since the investor’s first FHSA was opened OR

- The end of the year the investor turns 71 years old OR

- The end of the year after the year a qualifying withdrawal was made OR

- The end of the year after the year of the investor’s death

- Once any of these events take place, the individual would not be able to open another FHSA, regardless of whether they otherwise fit the criteria for a qualifying individual

What Happens to Unused FHSA Money

- Any savings not used to buy a home can be:

- Transferred tax-free to an RRSP or RRIF OR

- Withdrawn on a taxable basis

- If the FHSA remains open past any of the deadlines mentioned above, the FHSA becomes taxable

Upon Death

What happens to the FHSA after the account holder dies depends on whether or not they’ve designated a successor account holder or beneficiary ahead of time. Here are the options available to each designation.

| Options | Successor Account Holder (Qualifying Individual) | Successor Account Holder (Non Qualifying Individual) |

Beneficiary (Surviving Spouse) |

Beneficiary (other than a Surviving Spouse |

No Designated Beneficiaries (either in the contract or the will)** |

|---|---|---|---|---|---|

|

Become the New Holder of the FHSA:

|

X | ||||

| Transfer to their RRSP or RRIF* | X | X | X | ||

| Transfer to their FHSA* | X | ||||

|

Withdraw the funds:

|

X | X | X | X | X (Distributed to the estate)** |

* For this to be a direct transfer on a tax-deferred basis, it must be done during the exempt period (until the end of the calendar year following the FHSA holder’s death).

** An investor that has a beneficial interest in the estate may be able to fill out a prescribed form (more information to come) jointly with the legal representative of the estate to be considered a beneficiary as described above.