AGF Dividend Income Fund – Deconstructing the Option Overlay

By: AGF Investments • November 6, 2017 • Product Insight

AGF Dividend Income Fund seeks to provide investors with long-term growth combined with monthly income by investing primarily in high dividend yielding Canadian equity securities. The 30-40 stocks held within the AGF Dividend Income Fund, managed by Highstreet Asset Management, “Highstreet”, are the result of a rigorous stock selection and portfolio construction process. Attractive stocks are identified through a quantitative portfolio management process that evaluates and ranks stocks on the basis of fundamental and risk characteristics. While the process is mostly quantitative, Highstreet supplements the data provided by the model with research and ongoing fundamental analysis.

In addition to the core portfolio, the manager employs a covered call option overlay strategy for yield enhancement and risk-management purposes. The option overlay serves as an excellent complement to the core strategy of the Fund, generating additional income by selling call options on stocks held in the underlying portfolio.

WHAT IS A COVERED CALL?

Call options are contracts that give the purchasing party the right to buy the underlying stock at an agreed upon strike price at any time throughout the life of the contract. The call option is considered covered if the writer owns the actual equity shares that the contract is based upon. The underlying stock remains within the Fund and is only delivered to the option holder if they choose to exercise their option on or prior to the expiration date. This would typically only occur when the stock price is trading above the strike price.

The portfolio manager of the Fund writes (sells) covered call options on certain underlying holdings that are held. The options are generally out-of-the-money but can also be at-the-money as well. The premiums received for these options enhance the overall income generated within the Fund on a tax efficient basis.

HOW IS THE OPTION OVERLAY CARRIED OUT IN THE AGF DIVIDEND INCOME FUND?

On a monthly basis, the portfolio manager evaluates the opportunity to write covered calls for each holding in the Fund. The decision is made using a proprietary quantitative derivative model coupled with qualitative fundamental analysis. Each month, the quantitative option model screens the Fund’s holdings for factors such as volatility, momentum, and pricing, among other things, and suggests a route for covered call strategies on current holdings. From there, the portfolio manager analyzes the option model’s suggestions, evaluating them based on other fundamental factors and practicality and writes calls based on their level of comfort.

The contract length for the options used have approximately 30 days until option expiry and the level of strike is typically between 0% and 5% above the holding’s stock price. The maximum the Fund is allowed to write calls on is up to 35% of each individual holding.

WHAT ARE THE BENEFITS AND COSTS OF COVERED CALLS?

As mentioned above, a main benefit of a covered call overlay is the ability to generate a higher level of income, but an equally important benefit is that it can also help to protect on the downside. The primary drawback to using a covered call strategy is that any shares that do need to be delivered can put a ceiling on upside price appreciation potential.

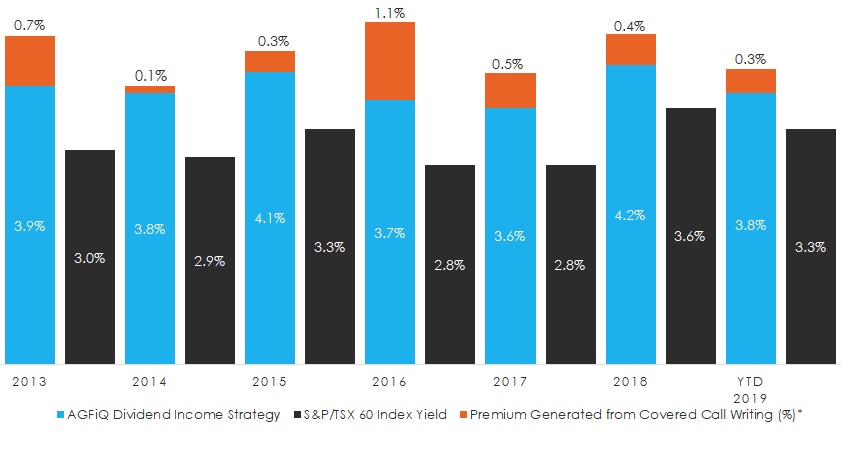

Ability to generate higher yield: as calls are written and premiums are collected, the overall yield can increase. Highstreet has been overseeing the AGF Dividend Income Fund since June 2015 but has been managing the Highstreet Dividend Income Strategy since 2012. As illustrated in the chart below, covered call writing has historically enhanced the level of income and added to the gross yield in addition to the dividends generated from the underlying holdings.

Source: FACTSET and Bloomberg, data as of May 31, 2019. Note: Performance is historical and not indicative of future returns. Fund performance is gross of portfolio management and administrative fees. Returns include the reinvestment of income and capital gains.

Downside protection: the option overlay can also help in down markets. During market downturns, the options are further away from being in-the-money and thus the chance to collect the full amount of premium without the call option being exercised is higher. The premium collected goes directly into the Fund. This additional income works as a cushion; boosting performance when underlying holdings may be down or flat.

Volatility reduction: the option overlay strategy may also lower the overall level of volatility of the Fund, potentially enhancing the risk adjusted returns of the Fund. The degree to which volatility is reduced is dependent on the strike prices employed, the percentage of the Fund that is written on, and the volatility levels prevailing in the market.

Capping upside: the potential cost of implementing such a strategy is that it can limit the upside that can be gained from strong performing stocks that have calls written on them. If the stock breaches above the strike price during the period and the shares must be delivered, the Fund does not benefit from the gain above the strike. In other words, gains from price appreciation can be capped on the portion that has calls written on it. It is worth noting again, however, that the Fund is only allowed to write calls only up to 35% of each individual holding as it is not part of the core strategy of the Fund.

The commentaries contained herein are provided as a general source of information based on information available as of October 3, 2017 and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein.

The information contained in this commentary is designed to provide you with general information related to investment alternatives and strategies and is not intended to be comprehensive investment advice applicable to the circumstances of the individual. We strongly recommend you consult with a financial advisor prior to making any investment decisions. References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AGF Investments. The specific securities identified and described herein do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable.

Publication date: November 6, 2017