Ready to Start Investing? These Top Tips Can Help

2 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

1. Know what you’re saving for

Is your financial goal to fund your retirement in 30 years, buy your first home in the next three years or something else?

Knowing what you’re saving for will help you figure out how long you have to save (your investment time horizon) and how much you’ll need to save each month to get there.

2. Consider your monthly budget

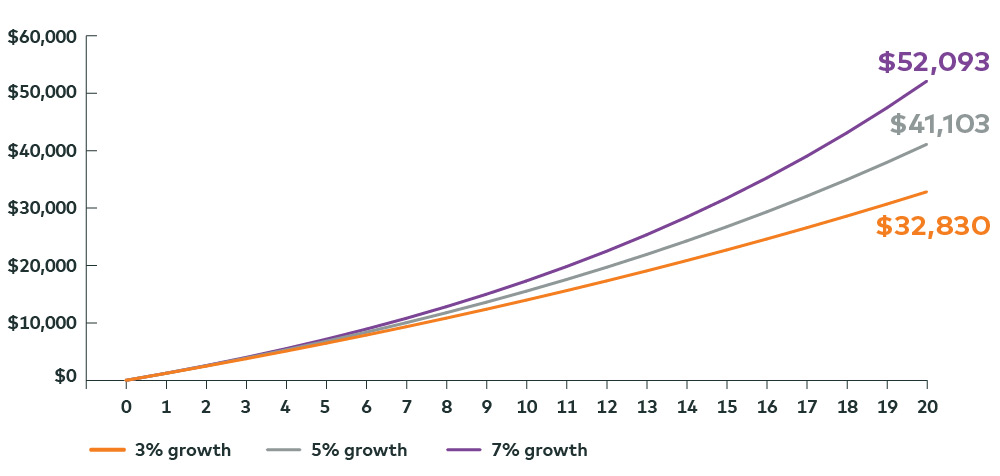

Think about what you would be willing to cut back on. For example, cutting out a $5-a-day coffee habit could help you save $100 a month. By investing regularly and following a consistent investment plan, you can take advantage of the benefits of compound growth, regardless of how much is invested.

3. Monitor your progress

Be sure to monitor your progress. If you’ve faced unexpected expenses or life events, you may need to adjust your goals or your time horizon. For example, you may need to save for a down payment on your first home over five years instead of three.

4. Determine how comfortable you are with risk

There are many different investment options on the market and each comes with its own level of risk. Typically, the higher the potential return of an investment, the higher the level of risk.

Are you comfortable with losing money on your investments from time to time, knowing that you could gain it back (and then some) over the longer term? Or do you lose sleep over the thought of your capital going down in value?

5. Work with a financial advisor

This article just scratches the surface of starting out as a new investor. There are many investment options available to you and other factors to consider, like diversification, liquidity, trading costs, account types and investment fees.

A financial advisor can work with you to choose investments that align with your financial goals, time horizon and risk tolerance. An advisor can also help you maintain a regular savings discipline so you can grow your money steadily over the long term.

Don’t have a financial advisor? Before you start your search, read about working with a financial advisor.

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this website are provided for informational and educational purposes, and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. Please consult with your own professional advisor on your particular circumstances.

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.