Five Ways to Boost Your Retirement Savings

2 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

By investing regularly, you can move steadily towards your financial goals and the retirement lifestyle you want.

Here are five ways to better save for your retirement:

1. Understand how tax sheltering works

Your investments grow tax-free within your RRSP, providing the potential for increased growth opportunities. You can enjoy immediate tax savings because an RRSP allows you to deduct the amount of contribution from your income on your tax return.

Read these articles to understand more about the key differences between registered and non-registered accounts.

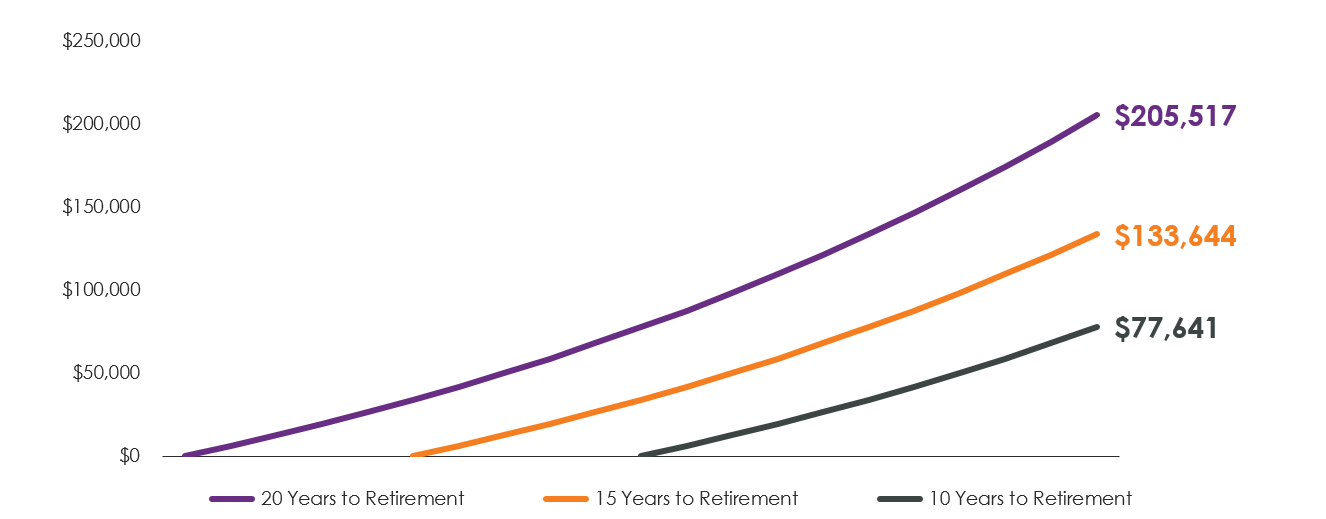

2. Start early

It may not seem like much now, but starting to invest 10 or 20 years earlier can have a dramatic impact on your long-term returns.

Hypothetical example:

Investors A, B and C all invest $500 a month in an investment that grows at 5% each year. By starting earlier, Investor A accumulated 50% more than Investor B – and nearly 3 times more than Investor C. All because of compounding returns.

Source: AGF Investments Inc. Performance returns presented are hypothetical and for illustrative purposes only. It does not represent actual performance nor does it guarantee future performance. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values or returns. Assumptions were made in the calculation of these returns including that this chart represents the growth of three hypothetical investments, assuming a 5% annual nominal rate of return compounded monthly, over the specified time periods. Any taxes due, trading costs and other fees associated with the portfolios are not included and trading prices and frequency implicit in the hypothetical performance may differ from what may have actually been realized at the time given prevailing market conditions.

3. Set up a pre-authorized purchase plan.

Setting up a PAC, i.e., a regularly scheduled contribution to your RRSP that comes right off your paycheque or out of your bank account, can help build your savings with minimal effort.

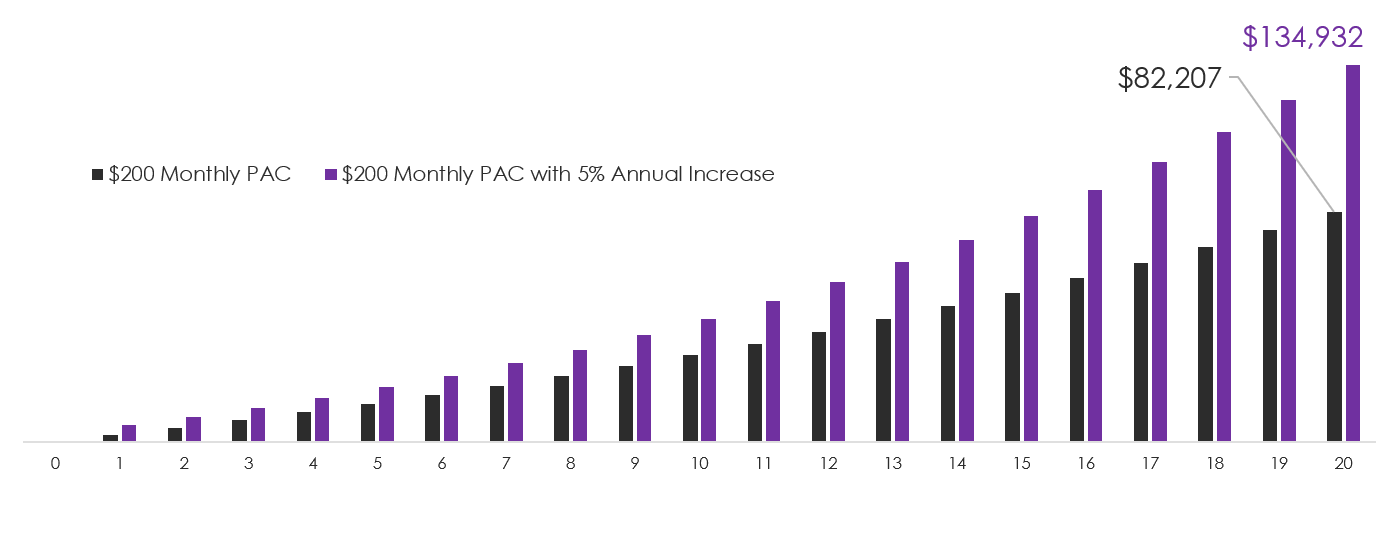

4. Consider increasing your contribution each year.

Don’t just automate your contribution – auto-escalate them – look at automatically increasing your contribution.

For example, if you increase your contribution by 5% each year:

- $100/month becomes $105/month in year 2, $110.25/month in year 3

- $200/month becomes $210/month in year 2, $220.50/month in year 3

Source: AGF Investments Inc. Performance returns presented are hypothetical and for illustrative purposes only. It does not represent actual performance nor does it guarantee future performance. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values or returns. Assumptions were made in the calculation of these returns including that this chart represents the growth of two hypothetical investments, assuming a 5% annual nominal rate of return compounded monthly, and monthly PAC contributions increasing by 5% each year. Any taxes due, trading costs and other fees associated with the portfolios are not included and trading prices and frequency implicit in the hypothetical performance may differ from what may have actually been realized at the time given prevailing market conditions.

5. Make use of your company benefits

Many companies offer employee savings or contribution matching plans. Check with your Human Resources department to see if you can take advantage of any employee programs that will help you build RRSP savings faster.

RRSPs are one of the best ways to save for your retirement and a financial advisor can help you choose the right investments for yours.

To learn more about RRSPs and saving for retirement, visit AGF.com/RRSP.

If you want to know how to find the right advisor for you, visit Working With a Financial Advisor.

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. This information is not meant as tax or legal advice. Investors should consult a financial advisor and/or tax professional before making investment, financial and/or tax-related decisions.

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.