Consider Both Inflation and Tax Implications.

Before Playing It “Safe”

3 min readBrought to you by Sound Choices - AGF Education for Investors and Advisors

Many investors like the safety and predictability that a Guaranteed Investment Certificate (GIC) offers. Your principal and interest payments are guaranteed by the GIC issuer (with “guaranteed” actually embedded in their name), so you know you’re going to receive your original investment back at maturity, and you also know exactly what you’re going to receive in the form of interest.

However, while GICs can fill a specific need in an investor’s portfolio, it is important to consider both the inflation and tax implications.

The break-even point

Do you know how much you have to earn with a GIC to break even with inflation and tax rates?

Canada’s annual inflation rate rose 6.8% on an annual average basis in 2022† – well up from the 20-year average of 2.1%††.

So looking at the 6.0% inflation rate numbers in the table below and assuming your tax rate is 30%, for example, you’d need a GIC paying 8.57% annually to break even! Even at the long-term average rate of 2%, you'd need 2.86%.

| 2.0% Inflation | 4.0% Inflation | 6.0% Inflation | 8.0% Inflation | |

| 20% tax rate | 2.50% | 5.00% | 7.50% | 10.00% |

| 30% tax rate | 2.86% | 5.71% | 8.57% | 11.43% |

| 40% tax rate | 3.33% | 6.67% | 10.00% | 13.33% |

Source: AGF Investments Inc. For illustrative purposes only. All rates referenced above are hypothetical.

So how can you stay ahead?

Given that the after-tax, inflation-adjusted returns of GICs can be relatively unattractive, especially when compared to many other investments, how can you stay ahead of inflation?

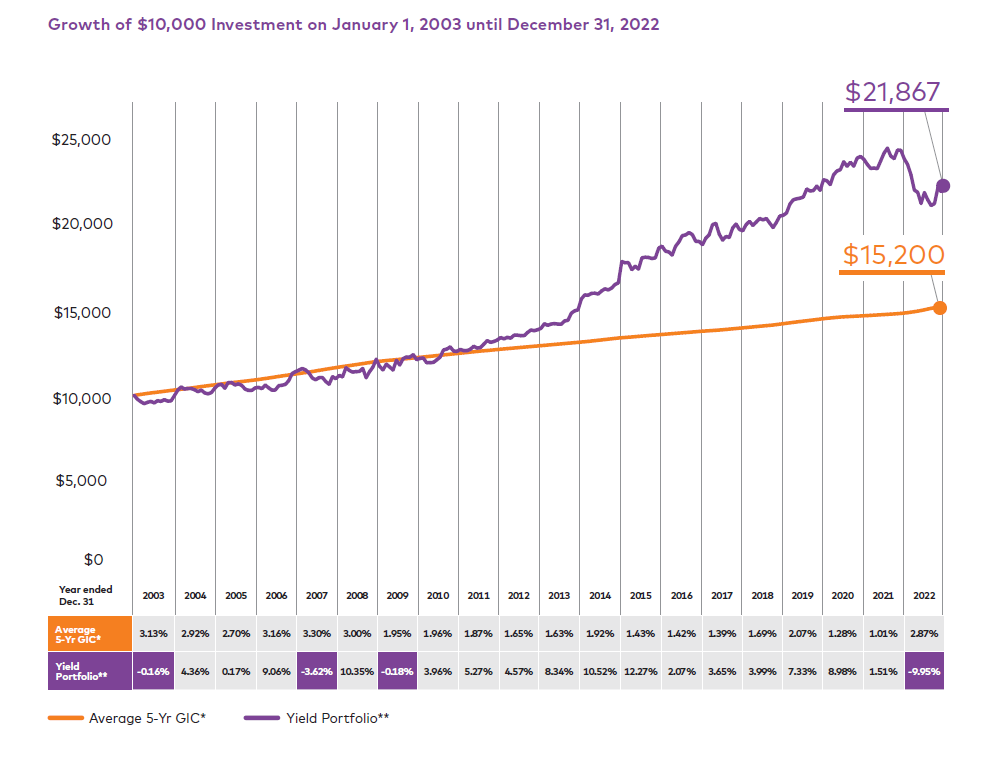

A managed solution, for example, is a portfolio invested in a mixture of equities, fixed income and cash. Their diversified nature can help to reduce volatility and increase long-term capital growth potential. Although the returns of funds aren’t guaranteed, the chart below shows that the returns can be stronger than those of GICs over the last 20 years.

Source: AGF Investments Inc. December 31, 2022. For illustrative purposes only. You cannot invest directly in an index. All information in Canadian dollars unless otherwise stated. Past performance is not indicative of future results. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the investment fund or returns on investment in the investment fund.

* Five-year average GIC Rate Index.

** The hypothetical portfolio weights and rates of return are for illustrative purposes only and should not be interpreted as a guarantee of future rates of return. The hypothetical portfolio is based on predetermined investments in the following indexes with the portfolio weights rebalanced monthly. The hypothetical portfolio is comprised of 60% Bloomberg Global Aggregate Bond Index, 15% Bloomberg Canada Aggregate Bond Index, 15% MSCI World Index, 10% S&P/TSX Composite Index. Any taxes due, trading costs and other fees associated with the portfolios are not included and trading prices and frequency implicit in the hypothetical performance may differ from what may have actually been realized at the time given prevailing market conditions.

You can find out more about managed solutions here. And your financial advisor can help you sort out how your investment portfolio can best meet your long-term needs.

†† Average annual inflation rate from 2003 to 2022. Source: https://www.bankofcanada.ca/rates/related/inflation-calculator, January 2023

All information in Canadian dollars unless otherwise stated. For illustrative purposes only.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).

“Bloomberg®” and Bloomberg Canada Aggregate TR Index, Bloomberg Global Aggregate TR Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”), and have been licensed for use for certain purposes by AGF Management Limited and its subsidiaries. Bloomberg is not affiliated with AGF Management Limited or its subsidiaries, and Bloomberg does not approve, endorse, review or recommend any products of AGF Management Limited or its subsidiaries. Bloomberg does not guarantee the timeliness, accurateness, or completeness, of any data or information relating to any products of AGF Management Limited or its subsidiaries.

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. This information is not meant as tax or legal advice. Investors should consult a financial advisor and/or tax professional before making investment, financial and/or tax-related decisions.

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.