Why the Fight Against Inflation May End in a Recession

3 min readThe first half of 2022 was one of the toughest in recent memory, but don’t cue the rebound in financial markets just yet. While the worst of the correction may have run its course, asset prices are expected to remain highly volatile as central bankers try to limit the negative impact of inflation and not cause a recession in the process.

Members of AGF’s Office of the Chief Investment Officer recently sat down to discuss the state of the economy and what investors might expect over the next six months as interest rates continue to rise and threaten a global slowdown.

Questions and answers that follow have been edited for clarity and length.

Is the global economy headed for a recession?

Kevin McCreadie (KM): If you look at nothing else but employment figures in the United States and other countries like Canada or in Europe, the economy seems healthy. After all, a high percentage of people are working, which, in the past, usually means strong demand for goods and services. But that’s not really the case right now. In fact, a global slowdown seems inevitable and certain economies including the U.S. may be closer to recession than some might think. In fact, if growth ends up being negative in the second quarter, the world’s largest economy might already be in recession – technically speaking – given the contraction in growth during the first quarter.

Stephen Way (SW): Investors need to be careful about equating a potential recession in the United States with a broader global recession. One of the most widely held definitions of a global recession is that GDP contracts to 1% or less – which is very different than two sequential quarters of negative growth, the defining characteristic of U.S. recessions. More importantly, global recessions don’t happen very often, and it seems unlikely this time around because of the potential for continued economic growth in other major economies like Japan and China. Of course, that doesn’t mean there won’t be a global slowdown, but it may not be as bad as some who are focused solely on what’s happening in one country or region of the world may believe.

David Stonehouse (DS): In fact, if you ignore what happened in 2020, there hasn’t been a global recession in the past 50 years in terms of an outright decline in global GDP.

Mark Stacey (MS): Agreed. A global recession seems highly unlikely but given the unprecedented amount of stimulus put into the system two years ago at the height of the pandemic and the amount now being taken out, there’s no doubt that a global slowdown is ahead. There’s evidence already that economic proxies like Purchasing Manager Indices (PMI) are inching lower towards contraction levels in countries like Germany and the U.S.

KM: Of course, the big concern in the United States, Canada and many other countries is inflation. It’s higher than we’ve seen in decades, which is starting to take its toll on consumers and demand for goods is beginning to slump. Sure, some people are getting wage increases, but, in most cases, its not enough to keep up with the higher cost of living associated with escalating food and energy prices. Moreover, the services side of the demand equation may soon start to wane despite evidence that people are eating out and travelling again following two years of intermittent lockdowns caused by the pandemic. For many, there just isn’t enough in the budget to keep spending on these types of discretionary purchases and with many central banks raising rates so aggressively to combat inflation, it’s not only higher prices, but higher mortgage, loan and credit card payments that people need to account for now.

MS: But higher rates seem to be the price that the U.S. Federal Reserve (Fed) and other central banks are willing to pay to kill inflation. The question is, how do they adjust if inflation does start to cool? Or what if there’s a significant economic slowdown and inflation stays hot? In that case, they may end up raising rates into and right through a recession, which hasn’t happened in a very long time, if ever. And how do governments react going forward? Normally, they might consider more stimulus to fight a slowdown but given how inflationary the last round of spending has been, that may not be the course of action this time around.

KM: The tone of the Fed has changed dramatically in recent weeks. It could be that nothing is going to stop them from getting inflation under control. That means it may not matter what unemployment is going to be in the short-term, nor does it matter what GDP growth (or lack thereof) is going to be in the short term.

DS: The Fed seems adamant about solving for a problem (i.e. inflation) that has an impact on the whole of society rather than worrying about unemployment, which affects a much smaller portion of the population. The only way I can see them stand down beyond inflation being reined in is a very large-scale recession that sends unemployment rates soaring, But that’s not really in the cards right now.

KM: Investors need to consider the political aspect of higher inflation as well. It’s become a wedge issue in several countries including the United Kingdom where Prime Minister Boris Johnson recently resigned in a scandal that coincided with criticism of how his government was handling cost of living increases. That’s not to say central banks are controlled by or influenced by politicians, but its hard not to believe the wherewithal to get this under control is being felt from multiple sides.

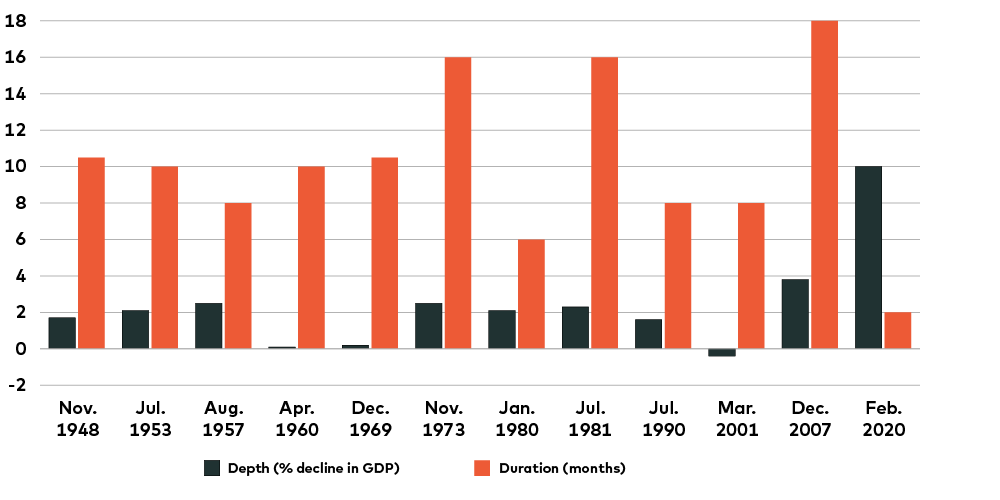

United States Recessions Since World War II

How low does the inflation rate need to get before the Fed stops raising rates?

DS: In the past, 2% was the target, but that’s not the case anymore. If the rate ended up somewhere in the range of 2.5%, the Fed would probably be thrilled. But that’s an end goal. In the meantime, the hope is to see the inflation rate drop below 4% in the next six to nine months and if the rate fell closer to 3%. the Fed would surely consider that a victory and would be more inclined to pause on raising rates further.

KM: I’m not sure the Fed keeps raising rates to get inflation to 2.5%. It may just need to see that it’s on the path to 2.5%. And that could be the type of pause that rallies markets even though it could coincide with the U.S. economy being in recession.

DS: But If the Fed hikes rates by another 2% over the next six months, as current estimates suggest, and inflation is falling but still at say 4.5% or higher, the Fed may be inclined to increase rates even higher. Of course, this is going to be predicated on the strength of the economy at the end of the year and would be more challenging to enact in a recession. Then again, if the Fed continues to hike beyond year-end expectations, the chance of a recession sometime in 2023 only becomes more pronounced.

Is there any chance the Fed can engineer a soft landing for the U.S. economy?

KM: This is like trying to steer an aircraft carrier. There are no brakes and to slow it down takes miles. And given the excesses the Fed needs to wring out, it will almost be impossible to slow inflation and not cause a recession in the process.

SW: There have been 13 tightening cycles since 1950, according to Trahan Macro Research, and the U.S. has avoided recession only three times. Moreover, when the Fed tightens with an inflation rate of 5% or greater, recession has never been avoided.

MS: The bar is high for them to stick a soft landing and this is the first time I’ve ever heard a Fed chairman say it’s going to be hard to thread the needle. Even during some of the worst crises, central banks usually express nothing but confidence in their ability to navigate the situation.

DS: The Fed will likely never forecast a recession outright. That would go against their mandate of providing stable and full employment, but the odds seem higher than usual that the U.S. economy is headed for one regardless of what the Fed says and does from here. Remember, it’s success rate in avoiding a recession when increasing rates is around 20% and that takes into consideration all types of scenarios from the benign to acute. There’s nothing benign about what’s happening today.

KM: A double dip recession is also possible if, in fact, one has already begun. In that case, the expectation is for a short recovery followed by another recession in the New Year as higher rates take effect and slow the economy again.

Given this uncertainty about inflation, what are your expectations for financial markets in the near term?

Rune Sollihaug (RS): It’s very difficult to predict the direction of markets in the best of times, let alone when there is so much uncertainty regarding inflation and interest rates. Equity markets may end up performing better than they did during the first six months, but volatility is likely to remain elevated for the next several months. The CBOE Volatility Index (VIX) has been trading in a heightened range since the beginning of the pandemic, but that shouldn’t be expected to change much going forward. At least not to the downside.

KM: It’s possible that the S&P 500 Index and other major indices that are down significantly end the year higher from where we are now. If it does, and the Index ends the year only down 6% or 7%, most investors would see that as a win.

John Christofilos (JC): The potential downside level for the S&P 500 Index is around 3400 if there’s a small recession. That’s equal to another 10% loss, but investors need to know that it’s not uncommon to have multiple 10% rallies higher in bear markets as well.

KM: To that end, it wouldn’t be a surprise to see the S&P 500 rally to a level near 4200 or higher if the Fed starts talking about taking a pause on raising rates because inflation is starting to peak. That may be true even if there is a recession because investors will start pricing in a recovery. But only if inflation has peaked. If it hasn’t, it could get uglier from here.

SW: Negative GDP growth and persistent inflation is not a good combination for the market, in part, because it likely means the Fed keeps raising rates, but it could be an even worse case for markets if the Fed relented on inflation because the economy is collapsing too quickly.

How do you expect equity markets to perform across different regions?

SW: From my own perspective, Asia Pacific may end up being the most attractive market, followed by the U.S. and Europe. Of the smaller markets, Canada has been a relative strength through the first half and that could continue if commodity prices remain strong.

MS: That makes even more sense if there’s a slowdown in North America and some of the emerging economies in Asia go the other way and stay relatively strong. Then again, the U.S. may end up being a stable place for investors in the case of a recession.

JC: That could be reflected in flows as well, with Asia leading the way followed by the U.S., and then Europe, which has been out of favour since the Ukraine War began. In particular, we’re getting more calls on the trading desk about Asia ex China these days.

SW: China’s equity market has been out of favour for a while now, but that may be changing given several positive catalysts including more fiscal stimulus from the government and expected rate cuts from the Bank of China. The country is also getting closer to approving its first mRNA vaccine to protect people against COVID-19, which could diminish the chance of another severe lockdown like the one in Shanghai earlier this year that severely disrupted economic activity. Regulatory restrictions on technology are being lifted as well and some sectors of the economy including real estate have been hit so hard already, they may have nowhere to go but up from here. That said, investors need to be patient. Demand is still not where it needs be on this front despite some of the fiscal measures being put in place to support consumers and businesses.

KM: China’s price/earnings is discounted when compared to the rest of the world. This is for the world’s second biggest economy which should have strong growth. Meanwhile, Emerging Markets (EM) have also been hammered, yet their economies have held up much better than many might have expected given the rise in the U.S. dollar. If this was playing out during the Asian Crisis in 1997, by comparison, many of these same countries would be in turmoil. So, they have weathered it well, but stock valuations not so much. The question is whether they are cheap enough now to account for their potential to provide higher growth going forward. The answer to that may depend on whether the country is an exporter or importer.

SW: That would depend on whether commodity prices can hold in here. -- Even in the case of a small recession, there’s a case for commodity prices to correct but not necessarily end up in bear market territory. That would be good for commodity exporters, but commodity importers would be challenged. If the U.S. dollar falls from here, that would also help exporters.

DS: EM assets start to look more attractive if the U.S. dollar peaks, but that may not happen for a few more months or until inflation peaks. In other words, if the Fed keeps hiking, there may be one more wave of U.S. dollar strength and EM may not do as well as it could otherwise.

SW: Japan also represents a potential opportunity for equity investors. The country, which came out of lockdown in the first quarter, won’t grow economically to the same extent as China, but its central bank isn’t tightening like others in the West. If they do end up raising rates, it won’t nearly be as aggressive.

KM: Japan will be interesting to watch because of the selloff in its currency, which makes Japanese assets cheap from a foreign perspective.

SW: That’s right. A weaker Japanese yen should benefit Japanese exporters from an earnings perspective.

What about fixed income markets?

DS: Bond yields may go up from here if inflation persists and the Fed must be more aggressive, but that also depends on what the market considers the greater risk: inflation or recession. Many believe recession is still a 2023 event and that inflation is more pressing, but that thinking is starting to shift and yields, because of that, may be close to peaking. Don’t forget, the yield on 10-year U.S. Treasuries has climbed 300 basis points, which already represents a huge cyclical bear market by historical standards. Plus, we’re eight quarters into the bear market, which, again, is long time for yields to be rising. As such, we are more constructive on duration – the risk of which has come down in recent months – but are still reluctant about going “long” in this regard just yet. We’re still cautious on credit as well. While spreads have generally widened over the past six months, they are only slightly more than the long-term average and opportunities should remain more selective – at least for now.

What other considerations need to be made when managing a portfolio in an environment like today?

MS: Investors will likely gravitate towards low-volatility stocks to weather the storm, but also focus on companies with relative earnings growth and quality balance sheets. Value is important but some may start paying a premium for growth.

KM: I would characterize that trade as growth at a reasonable price. People will likely pay for growth, but not speculative growth.

SW: Profitless companies are in tough, but there could be opportunities in high-quality cyclical growth companies that generate high free cash flow and have pricing power. This may include some of the big traditional tech names even though many of them are still trading at large premiums to the broader market.

KM: People are willing to pay a premium for companies that are anchors in an uncertain economy.

RS: Another aspect to consider is risk management. Because market volatility is elevated, portfolios have generally become riskier, both in absolute terms, but also relative to a benchmark. Hence, the need for a disciplined active management approach along with strong risk management becomes important. For example, tracking error – which gauges how closely a portfolio follows a benchmark – can be a useful risk metric to watch in these types of environments because it often spikes when VIX levels rise. The question is whether such a spike is within reason or whether it reflects a level of risk to the portfolio that is no longer in line with the objective of it. Of course, if it’s the latter, that’s when adjustments may need to be made, including higher cash positions than usual depending on the situation.

JC: It’s also important to remember that volatility can be an opportunity as much as a hindrance from a trading perspective. It can often help investors buy into quality companies they like at prices that are discounted.

Finally, what about asset allocation?

KM: Based on a 60/40 portfolio, the AGF Asset Allocation Committee continues to overweight equities versus bonds and holds more cash than is usually normal. It also has a small equity market neutral allocation that has helped smooth some of the volatility experienced in the first half of the year, precisely by providing uncorrelated returns to the U.S. market. Granted, it’s still a very challenging environment for investors. Yet opportunities do exist for those who understand the potential outcomes for the global economy and what these various outcomes mean for financial markets over the next six months.

The views expressed in this document are those of the author(s) and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of July 8, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

This document is for use by Canadian accredited investors, European professional investors, U.S. qualified investors or for advisors to support the assessment of investment suitability for investors.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence

RO: 20220715-2288871

Inside Perspectives: An AGF Podcast Series

The Ukraine War: The Other Risk Facing Investors in the Second Half of the Year

Listen to the PodcastSubscribe

Get insights directly to your inbox

Subscribe Now